Analyze Any Company

Begin your search here

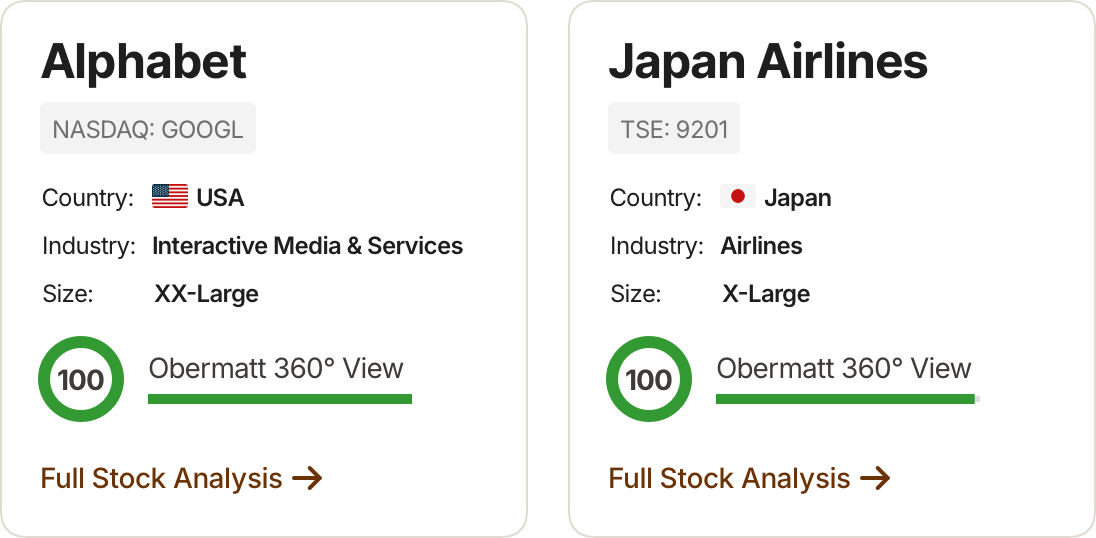

Obermatt analyzes over 6,500 companies across 60+ global markets, enabling investors to identify top-performing stocks quickly. Our research ranks each stock by performance relative to competitors, with higher ranks indicating higher company performance.

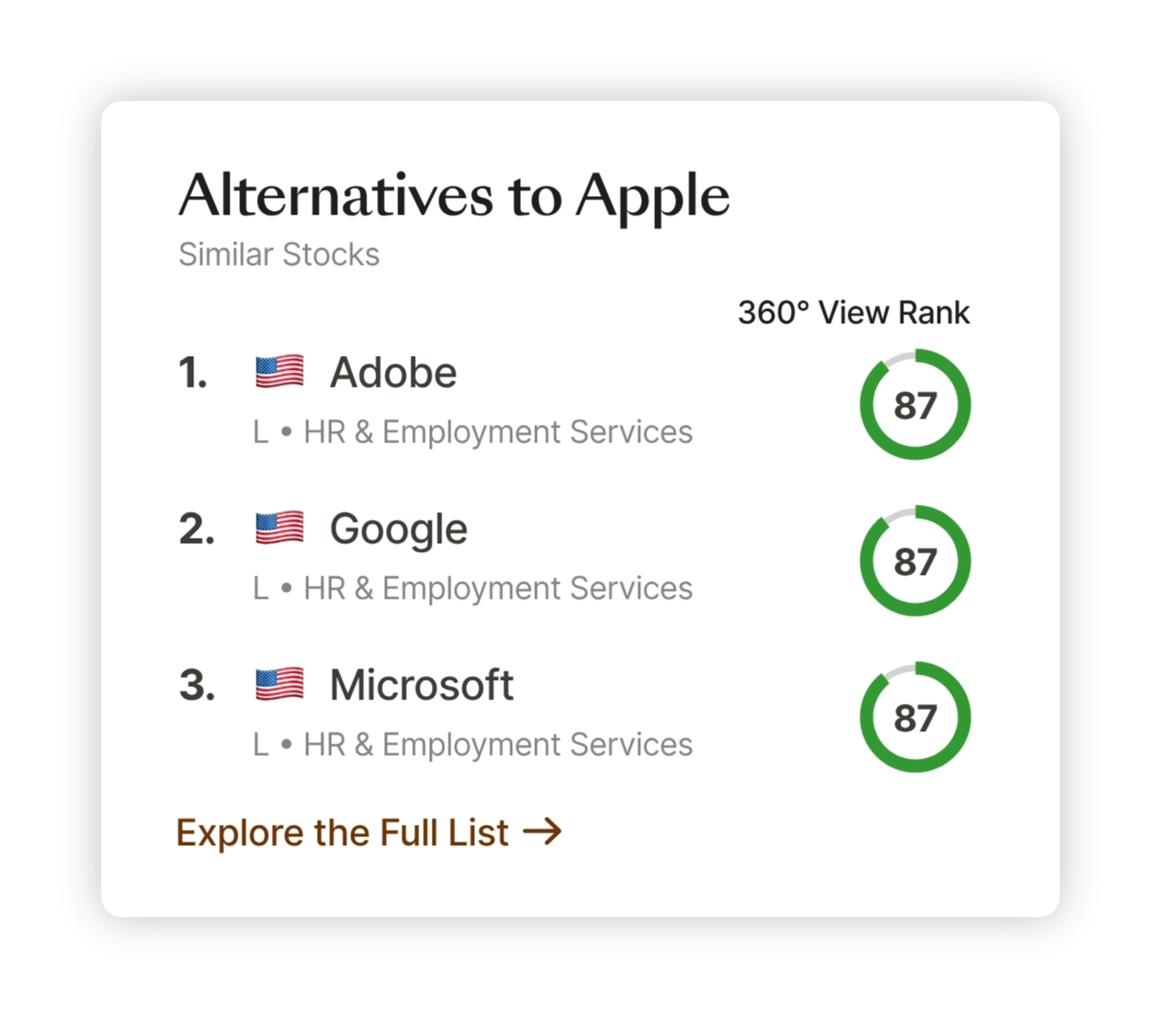

Similar Stocks

Find highly-ranked alternatives

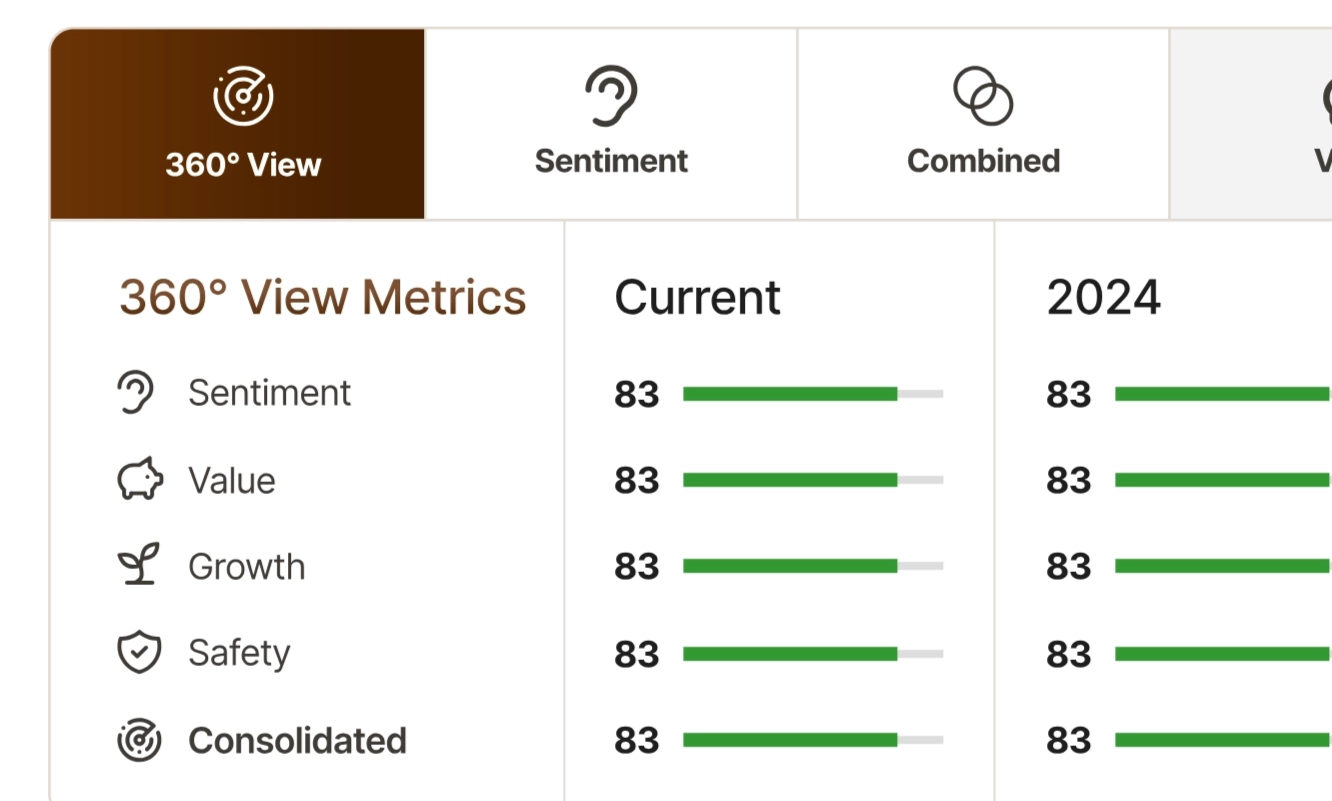

In-Depth Ranks

See detailed company analysis