Even though changes are obviously a part of life, people seem to have a hard time dealing with them: They hate winter and rain and they wish the sun would always shine.

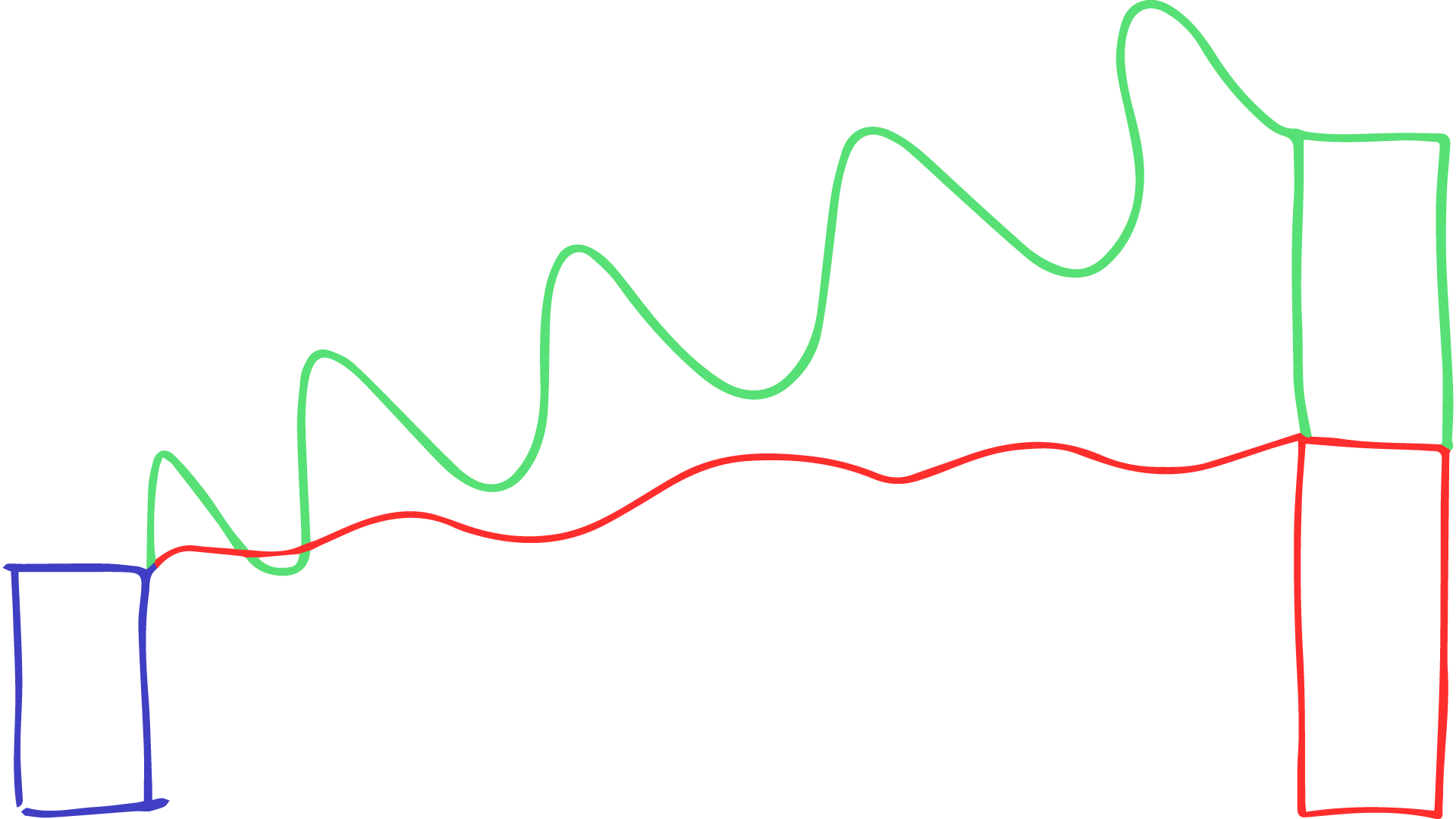

And when they invest in stocks, they want the value of their shares to go up continuously. However, given that you’re not saving for the few years that stock market cycles usually cover, but rather for 20, 30 or 50 years, you can safely ignore the short-term fluctuations of your portfolio.

More importantly, stocks that fluctuate more typically have higher long-term returns than those that fluctuate little. The point? Fluctuations are not bad.

They might hurt and our need for security and freedom from pain might suggests to us again and again that the loss in value of a stock is a problem.

But that is not the case – our gut feeling is leading us astray.