Recently, Finanz & Wirtschaft (FuW) recommended investing in "value" markets because the value strategy was the best investment strategy in 2016. A picture of snow-covered Moscow underscores the results of the study in the FuW article. Because Russia is currently a value market, you should be invested there.

The value strategy is based on investment in companies that are favorably priced, compared to their size. The US investment thinker, Benjamin Graham, first postulated the theory in 1949. Warren Buffett has made a lot of money using this strategy, and Robert J. Shiller was recently awarded the Nobel Prize for proving that the value strategy actually works.

At Obermatt, the value strategy is also central to our investment strategy. The Obermatt Top 10 Value shares last year were the most profitable assets, just like with FuW.

The Obermatt Value Top 10 shares beat their 56 indexes on average by a whopping 8.6%. Value stocks were better than the indexes in 35 out of 56 markets, or by an astounding 63% (graphic below).

As in the case of FuW, Russia is also a value market at Obermatt, but Japan, South Korea and Taiwan are even better.

The problem with the FuW article is not the analysis, but the conclusion. Do you have to invest in value markets now?

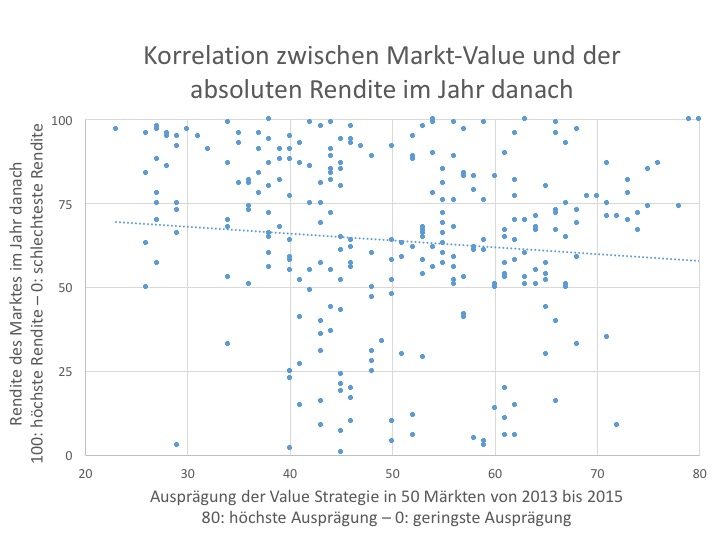

Not necessarily. For years, we have seen the value strategy work reliably for individual stock selection, but, unfortunately, there is no correlation between the market "valueness" and the later return of that market.

As you can see in the picture, and as is shown in the video, the return in the following year has nothing to do with the "value" of the market in the year before. In our data set, the correlation is even slightly negative. Investing in a value market, therefore, doesn’t generate a lot of profit.

How can this be explained? Our explanation is that at market level, mistakes are balanced out in evaluations of individual companies. A high value in the Russian market then only means that it is worth less than the others, and not that there are good investment opportunities. This can happen, but is a pure coincidence.

Reference: FuW: "Diese Länder sind günstig bewertet", page 17, 18 January 2017