We can already tell that the economic year 2025 will certainly still be talked about in the future. The events surrounding the surprising US trade measures and the subsequent market reaction have left their mark, not only in the portfolios of many investors, but also in the collective memory of the financial world. Within just a few days, global stock markets came under pressure, important indices such as the S&P 500 suffered double-digit losses and memories of previous crises came flooding back.

What is a market correction?

A market correction generally refers to a noticeable decline on the stock markets, typically a price drop of at least 10% from the most recent high. It thus differs from a bear market, which begins with declines of 20% or more. Corrections can occur within a few days or weeks and are often considered a normal, even healthy phenomenon: they allow the overheated market to “correct” and consolidate before the upward trend continues. Historically, such setbacks are frequent: since 1950, the S&P 500 index has recorded 37 corrections of at least 10 %, i.e. one every 1.6 years. For long-term investors, these episodes are generally temporary: the markets have always recovered so far. On average, it took around 8 months for the S&P 500 to recover a price loss of 10-20 %. Corrections are therefore usually relatively short-lived. However, if a recession is involved, the slumps can be deeper and the recovery can take longer - this is often referred to as a bear market.

Historical examples of significant corrections

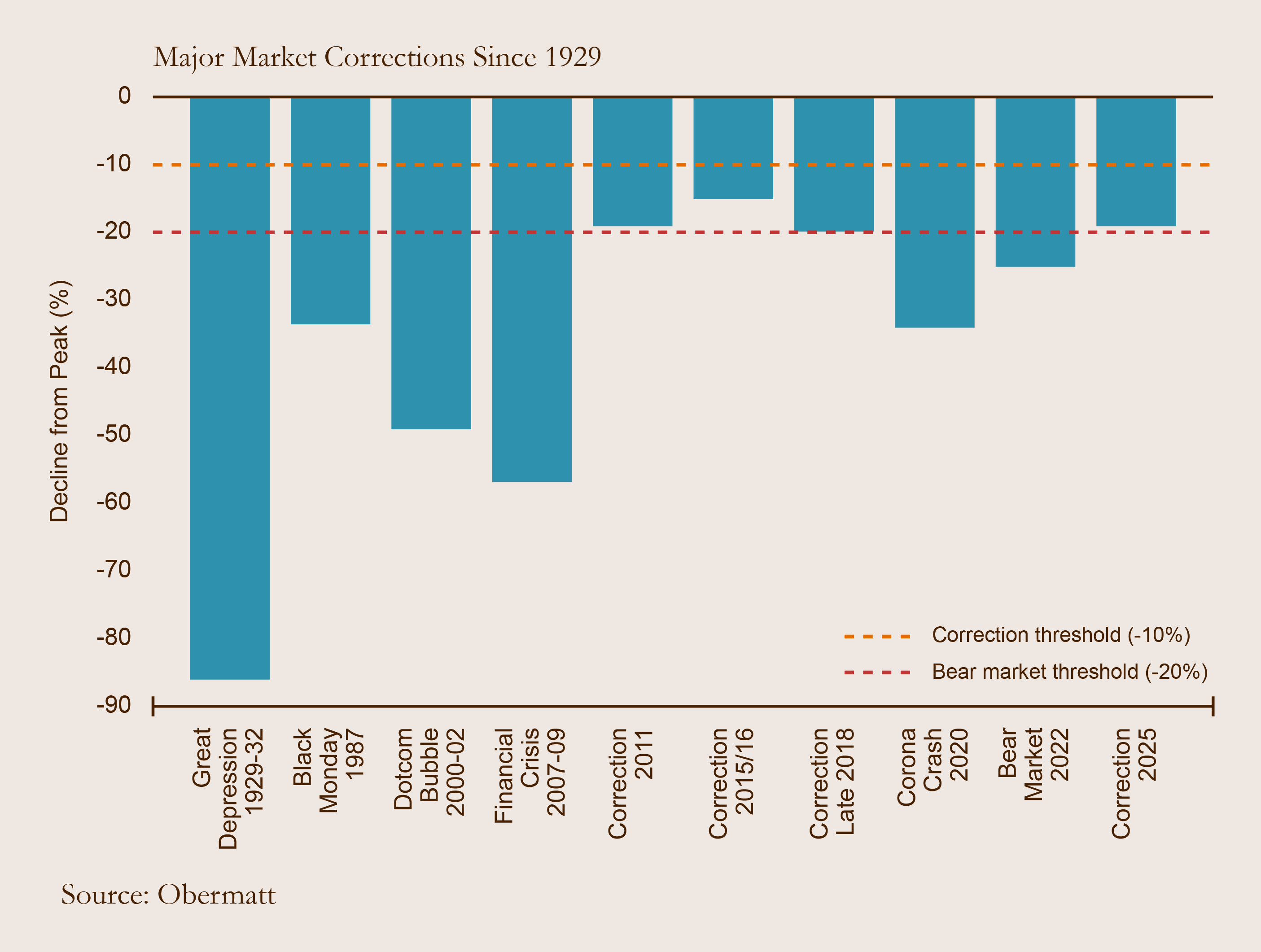

In the past decades, there have been a number of market corrections of varying intensity, from short price setbacks to global crashes. The US stock market in particular has seen several significant declines, most of which were also felt on stock markets worldwide. The following chart illustrates correction phases in recent years using the S&P 500 Index:

As early as 2000-2002, the bursting of the dotcom bubble led to massive losses: the technology-heavy Nasdaq index plummeted by almost 80 % and the S&P 500 lost around half its value. It took over 5 years for the S&P 500 to return to its previous level (in October 2007). This was followed shortly afterwards by the global financial crisis of 2008: from October 2007 to March 2009, the S&P 500 fell by 56.8 % to its lowest level since 1996. Markets also collapsed worldwide; many stock exchanges lost around 40-50 % of their value during this period. The recovery took time - the S&P 500 only climbed sustainably above its pre-crisis high in 2013.

The 2010s saw more frequent medium-sized corrections: in 2011, the euro debt crisis and a US downgrade led to an almost 19% setback in the S&P 500. In 2015, growth fears in China caused stock markets around the world to tremble (the S&P 500 fell by 12-15%, emerging markets by even more in some cases). This was followed by a sharp but brief correction at the end of 2018: fears of rising interest rates and trade conflicts caused the S&P 500 to lose almost 20 % between September and Christmas 2018 - the worst week since the financial crisis. However, the market quickly turned around: thanks to the Fed's less stringent policy, the index climbed back to new highs in April 2019.

The coronavirus correction in March 2020 stood out as one of the sharpest and fastest in history. Within just one month, the S&P 500 plummeted by 34% (from its all-time high on February 19, 2020 to its low on March 23, 2020) - accompanied by panic selling around the globe. Many international indices fell similarly sharply; the German DAX lost around 25 % in the first quarter of 2020 and the MSCI World Index around 34 % from its high.

Nevertheless, this was followed by an astonishingly rapid recovery: thanks to massive monetary and fiscal policy stimulus, share prices returned to their previous levels by August 2020. Investors who kept their cool were back at “break-even” after around five months.

The stock markets last experienced a prolonged bear market in 2022. Driven by the inflation shock and interest rate turnaround (rapid interest rate hikes), the S&P 500 Index fell by around 25 % from its annual high by October 2022. Global markets performed similarly: in Europe, the STOXX 600 Index fell by ~20 % at times, with many tech stocks losing much more. The stock markets stabilized again in 2023, and by 2024 large parts of the losses had been made up - once again demonstrating the resilient, long-term upward trend of the stock markets.

The correction in April 2025: trigger, course and current situation

In spring 2025, there was another significant market correction - this time triggered by a trade conflict. At the beginning of April, US President Donald Trump announced drastic new tariffs on imports affecting dozens of countries. This news shocked the markets: within two trading days of Trump's announcement on April 2, the leading US indices plummeted by more than 10%. On 3rd of April, Wall Street even recorded its biggest price slide since 2020, with the S&P 500 losing over 12% of its value in just four trading days - a slump that caused the index to lose around USD 5.8 trillion in market capitalization. On April 8, the S&P 500 closed below the 5,000-point mark for the first time in almost a year. Overall, the index approached a bear market threshold: the drop from the last high was close to 20 % at times.

The Nasdaq and small-cap stocks also suffered badly. The Nasdaq Composite fell into correction territory and traded in double digits below its all-time high. Small caps (smaller US companies) in particular came under pressure. At the same time, volatility shot up: The VIX index climbed to around 47 points, its highest level since the pandemic shock in March 2020. This extreme nervousness was felt around the world:

- Global markets: Stock markets around the world were hit hard. European equities recorded their biggest slide in years - the STOXX 600 Index fell by around 4.5% in one day at the beginning of April, reaching its lowest level since January 2024. In Asia, markets such as Japan's Nikkei and Hong Kong's Hang Seng also fell significantly. Overall, the MSCI World Index fell to its lowest level since mid-2024 at the beginning of April.

- Bonds & commodities: Fears of tariff escalation initially drove investors into safe havens such as government bonds. US yields fell in the short term before the prospect of possible interest rate cuts materialized later on. Oil prices came under pressure due to fears of a global trade war weakening demand.

Despite the turbulence, there were initial signs of stabilization in mid-April 2025, with many investors betting that the US Federal Reserve (Fed) would intervene in view of the increased risk of recession - futures priced in several interest rate cuts for 2025 over the course of the month. Market players are also hoping for a diplomatic easing of the tariff dispute: the EU, for example, has signaled a willingness to talk in order to avert counter-tariffs.

Prices did indeed recover somewhat from their lows in the second half of April - the S&P 500 was back above 5,200 points on April 20, around 8% above the low from the beginning of the month. The first talks with China and a temporary easing of tariffs have now also taken place, which has helped share prices to rise further. Nevertheless, the situation remains volatile as the outcome of the trade dispute is uncertain.

How to act in correction phases

Market corrections can be emotionally challenging. However, it is crucial to act calmly. Investors can skillfully maneuver through a correction with the following advice:

- Stay calm and avoid panic: Don't get carried away by a price slide and sell hastily. If you sell everything during a crisis, you will realize losses and often miss out on the following recovery. Instead, don't sell just because others are selling. Studies show that panic selling ultimately leaves investors worse off than if they had stayed invested. Patience is key during corrections.

- Focus on the long-term plan: Remember your investment goals and time horizon. Short-term fluctuations do not change the long-term prospects of good investments. Don't try to time the market - it's almost impossible and often leads to missing the best days on the stock market. Instead, it rewards you to stay true to your strategy and follow the maxim “time in the market beats timing the market”. Long-term buy-and-hold has historically proven to be successful.

- Diversification and quality: A broadly diversified portfolio helps to withstand corrections better. Make sure that your investments are spread across different regions, sectors and asset classes. This reduces the risk of a single trigger (such as a slump in the tech sector or in one country) having an excessive impact on your entire assets. The value of solid quality stocks and stable investments in the portfolio is particularly evident during crises.

- Seize opportunities - buy cheaply: Corrections often offer the opportunity to buy high-quality shares at a lower price. As investment legend Warren Buffett advises: “The more [the market] falls, the more I like to buy”. So check whether a fall in the share price of solid companies could be a good time for you to buy. If you have liquid funds, you can invest them gradually during such phases. It is important to proceed in tranches and not try to catch the absolute low - it is rarely possible to catch the perfect time. In the long term, investors who bought in during corrections instead of exiting have been rewarded.

To take away

Market corrections are part of the game. Although they are sometimes painful, they are temporary. The key is to keep a cool head and stick to your long-term strategy. Historically, all major falls on the stock markets have evened out again - often more quickly than expected. Investors who remain disciplined, diversify broadly and see crises as opportunities can emerge stronger from correction phases.

Corrections on the US market and globally are nothing unusual - setbacks of 10-20 % occur almost every year and often serve as a “reset” in longer upward trends. Past examples show that even severe crashes have ultimately been overcome. For private investors, this means not panicking in such phases, but acting in an informed and considered manner. Those who take the lessons of the past to heart can calmly view a current correction as part of the investment cycle - and set the course for long-term success.