It’s official! We rang the bell of the SIX Stock Exchange in Zurich and announced the Obermatt Swiss Pearls Index (OMSP1) ETP to more than 60 potential investors. They found out why investing in the SMI or the SPI doesn’t actually mean investing in the Swiss economy - it’s more like a bet on pharmaceuticals and Nestle. The 36 Swiss stocks in the OMSP1, however, are more diversified and better reflect the composition of Switzerland’s economy.

The Obermatt Swiss Pearls index is investable and traded on Switzerland’s SIX stock exchange, thanks to our partners Maverix Securities and Amasus Investment, with all the details here.In case you missed it, this is why the OMSP1 is a smart choice.

What drives Switzerland? It’s more than only pharma and Nestle.

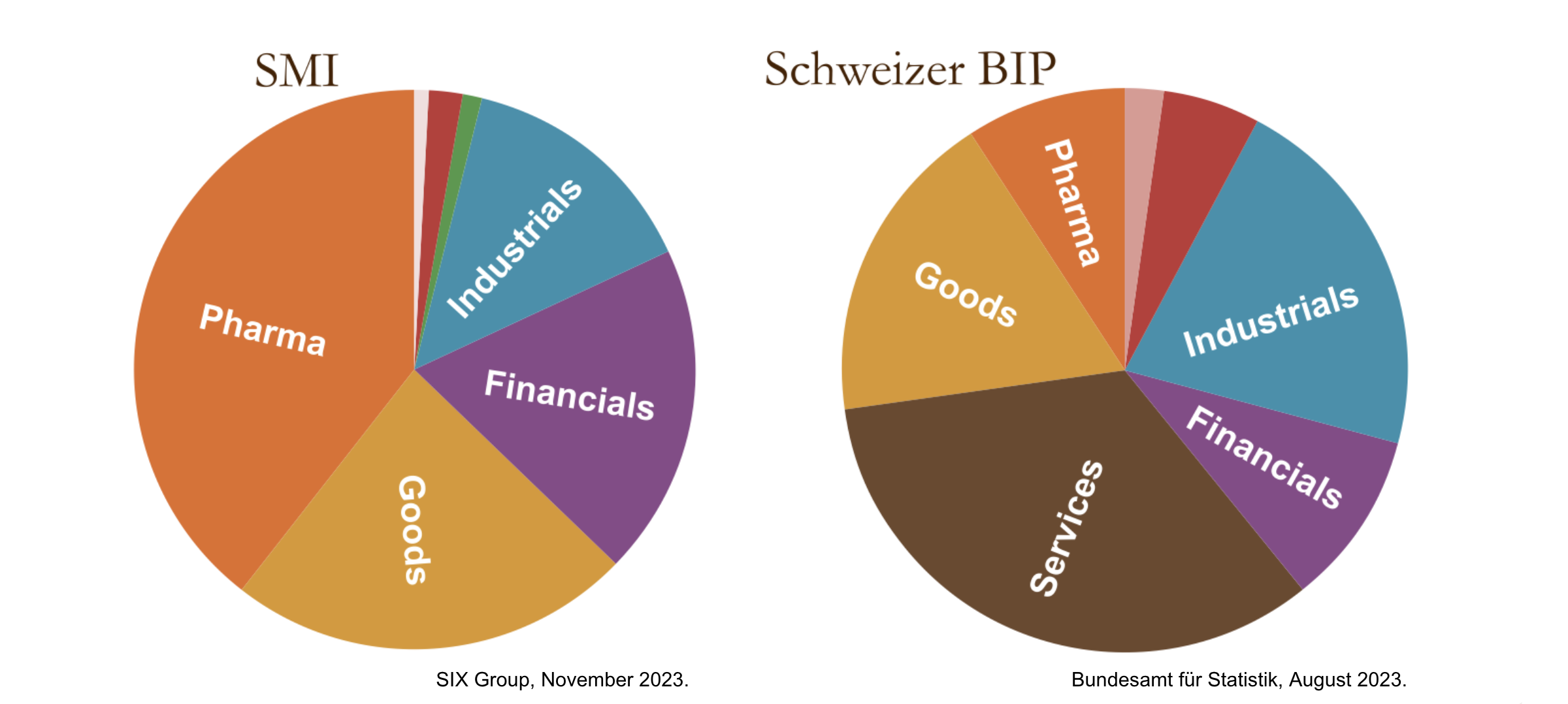

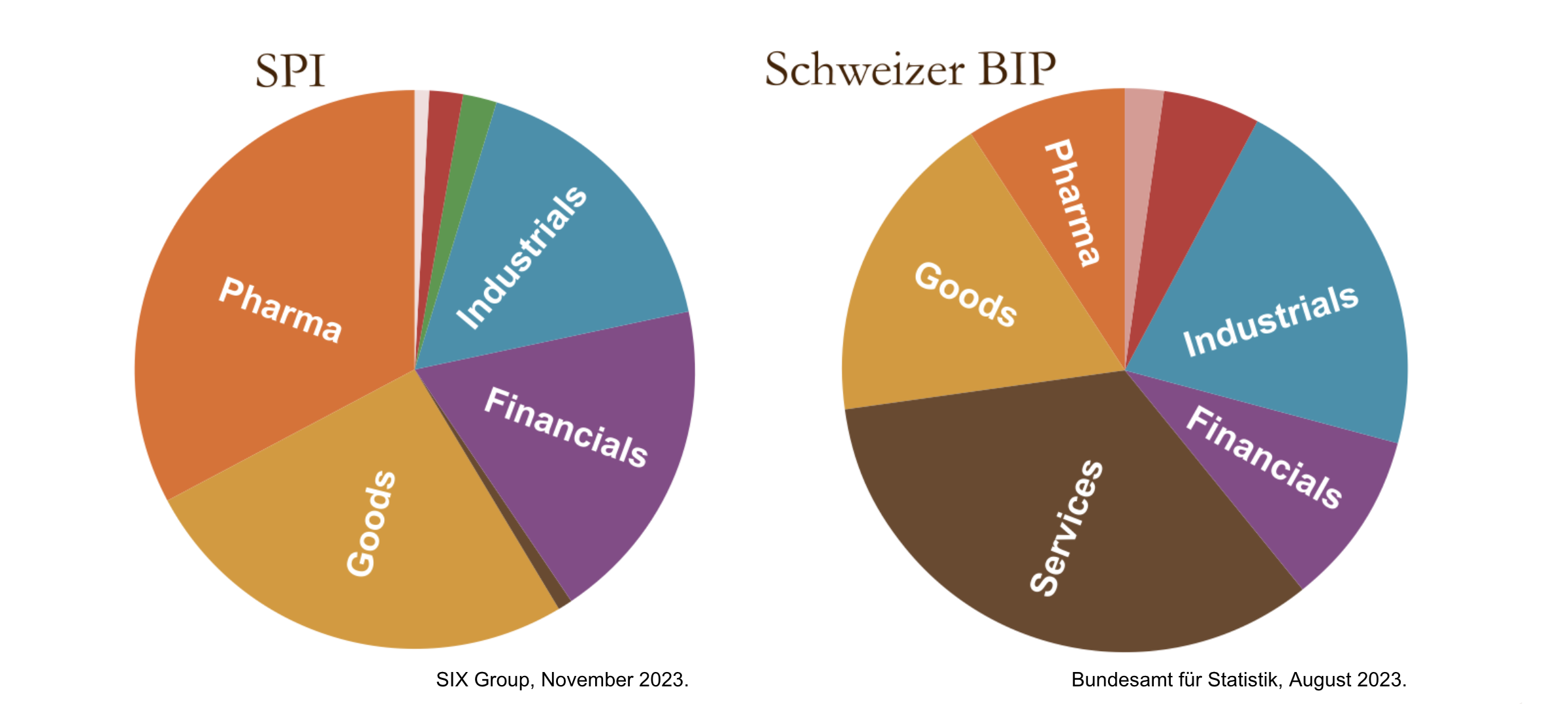

Pharma + Nestle ≠ Swiss economy. Both the SMI and the SPI are largely dominated by pharmaceuticals and Nestle. The Swiss GDP, however, paints an entirely different picture. The world-over, Switzerland is known for much more than simply pharmaceuticals and Nestle. Aside from banking and industrials, the services industry, including travel and hospitality, account for a large portion of the Swiss economy but are not represented in either the SMI or the SPI.

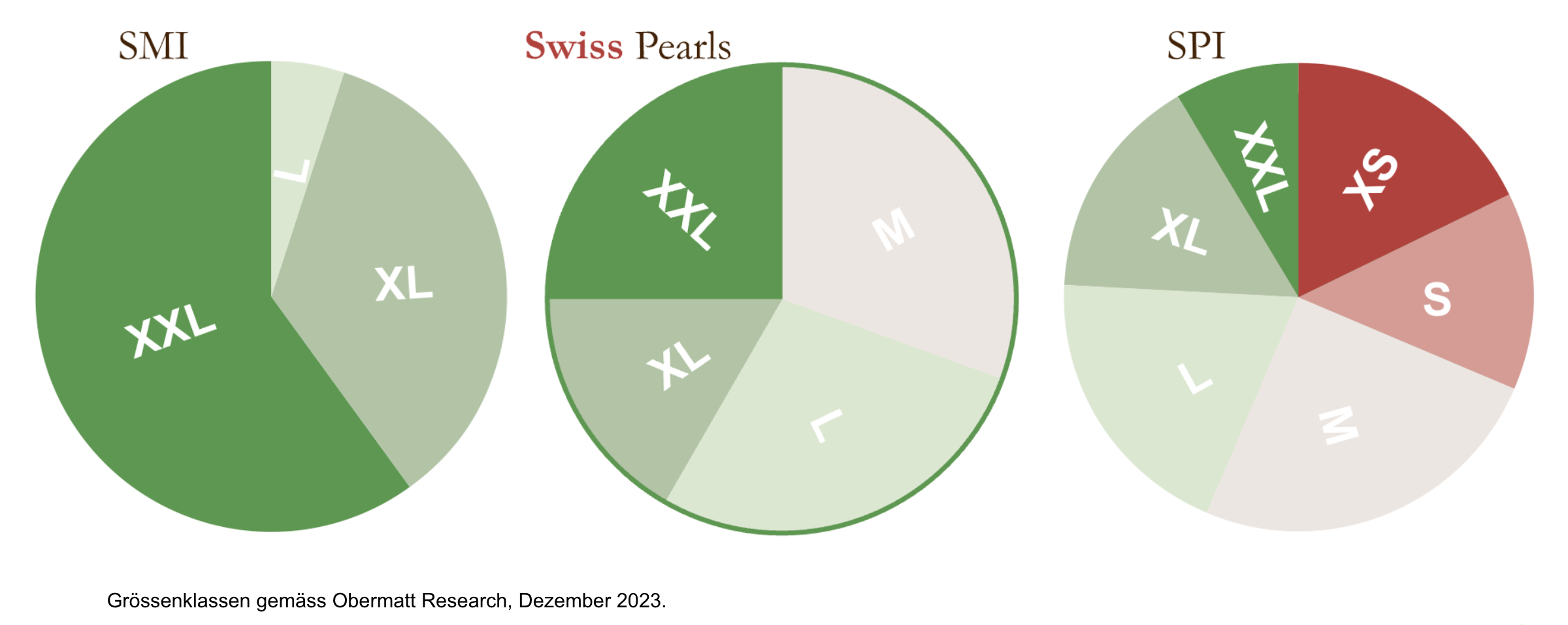

The SPI is much bigger, with around 240 stocks in it and yet, it is not better diversified across industries! On top of that, the SPI doesn’t only contain the large companies like in the SMI, it also contains a large number of small companies, which have neither analyst coverage nor high trading volumes. Both of these factors can make those small companies rather risky investments. The Obermatt Swiss Pearls Index also includes medium-sized stocks, which are absent from the SMI but does avoid the very small, risky stocks that are included in the SPI, namely the stocks with the sizes S and XS according to the Obermatt classification are marked in red.

The weaknesses in the SMI and SPI are what drove us to create the Obermatt Swiss Pearls Index, 36 stocks that better represent the Swiss economy. It is based purely on Swiss stocks that Obermatt covers - those with enough trading volume and analyst coverage - ranked by their Obermatt 360° View. These 36 stocks are selected based on their performance across numerous financial and non-financial metrics, not simply their market capitalization (as drives the SMI and the SPI).

We actively review and maintain the index, together with our partners, Maverix Securities and Amasus Investment by conducting monthly analysis of the ranks of all eligible companies that we cover. The stock with the weakest overall performance gets sold and the stock with the highest performance gets its spot in the OMSP1 index. We are very transparent with our decisions and post all the updates right here in our blog, as well as this dedicated page.

Stay tuned for more info on the new ETP product. Happy investing throughout the holiday season!