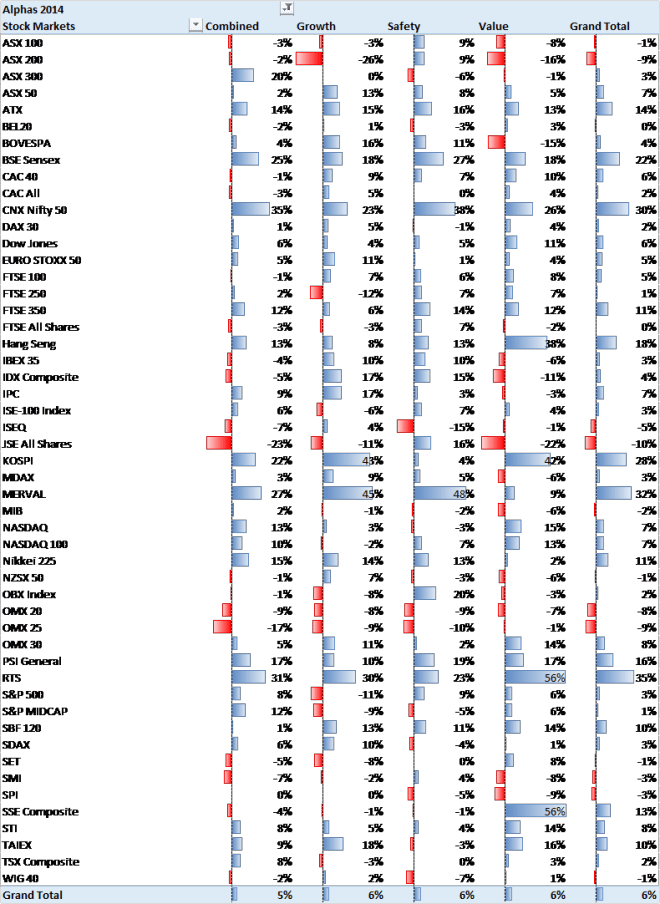

We have analyzed the performance of the Obermatt Top 10 stocks for 2014 and we are happy with the result. In 2 out of 3 stock markets, you were better off purchasing the Obermatt Top 10 stocks than an index fund. On average, Obermatt Top 10 Stocks outperformed the corresponding stock market indexes by 6% as seen in the graph below. Underperformance was noted in the Northern European countries, Switzerland and Australia.

What does this mean? If an Obermatt investment strategy outperforms the market, it means that stock fundamentals are important in that market. If it doesn’t work, it means that stock prices moved without corresponding changes in fundamental performance of the company. “Fundamentals” are financial performance indicators such as stock price, sales, profits, dividends and leverage (amount of debt relative to company size).

Do fundamentals matter? In the long-term they do. You only invest in a company if you get a share of its profits. If profits don’t go up, share prices can’t go up – in the long-term. Except of course, if expectations for the future change. If suddenly the future looks brighter, then stocks move up even without corresponding changes in fundamentals today. The same happens to stocks that are safely financed it the future looks frightening. Then you want to buy stocks that have a solid balance sheet.

In contrast to 2014, fundamentals have been less important in the first quarter of 2015. Overall, the strategies underperformed the indexes by -1% and in the majority of situations. To me, this looks like the stocks move more arbitrarily than in the last five years where we could observe a better correlation between stock prices and fundamentals. Does this mean that we might be soon seeing the end of the up-cycle? Possibly, as the current valuation ratings in most Western stock markets are quite low (a rank of below 50 in Obermatt speak). In other words, stocks look quite expensive right now.

The Obermatt investment strategies outperformed the stock indexes by 6% (Value, Growth and Safety strategy) and 5% (Combined strategy). This means that the Obermatt Top 10 stocks on average did 5-6% better than the corresponding stock indexes themselves.