Searching for stock ideas? Explore other Top 10 lists, filter for stocks with our stock filter, or search for individual stocks by signing up.

|

Name

|

360° View

|

Sentiment

|

Combined

|

Value

|

Growth

|

Safety

|

|---|---|---|---|---|---|---|

|

S • Asset Management & Custody

|

100

|

86

|

100

|

67

|

75

|

88

|

Perpetual stands out in the ASX 200 with a 360° View of 100, placing it ahead of 100% of its peers.

See the full Perpetual analysis|

Name

|

360° View

|

Sentiment

|

Combined

|

Value

|

Growth

|

Safety

|

|---|

No top 10 list was published for this market, date and strategy.

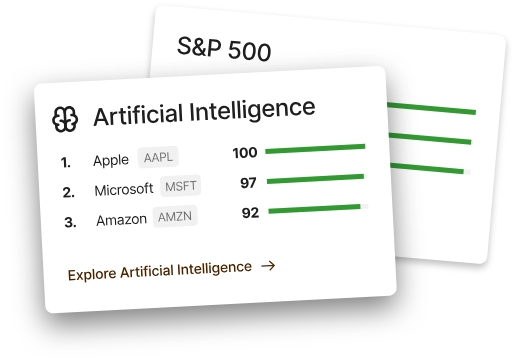

Our lists are generated by a proprietary algorithm that analyzes over 6,500 stocks weekly.

Stocks are ranked by our 360° View, which measures all-around strength in Value, Growth, Safety, and Sentiment.

The results are completely data-driven and independent, free from market hype or analyst opinion.

The Obermatt Top 10 lists are algorithmically generated lists that identify the 10 stocks in a specific market or index with the highest 360° View. The holistic 360° View ranking consolidates into one number a company's overall fundamental financial strength and its market sentiment as compared to its peers.

The ASX 200 measures the performance of the 200 largest index-eligible stocks on the ASX by float-adjusted market capitalization. It is widely considered Australia's preeminent benchmark index.

The stocks that top Obermatt's ASX 200 list are often not the stocks that are the most popular or the most hyped. Those are often over-priced. Obermatt selects stocks based on performance, not hype.

The Top 10 ASX 200 stocks are updated on the 10th day of every month.

Any visitor can view the 360° View of the last three stocks on the ASX 200 list. A Premium subscription is required to unlock the complete list with the ranks for not only the 360° View but also the Value, Growth, Safety, Combined and Sentiment ranks. Obermatt's objective, data-driven analysis is financed by our subscriptions.

Obermatt's proprietary Investment Themes are a response to investor demand to find the best stocks according their interests, be they high growth areas like AI, Robotics, Renewables, or sustainability values like Governance Leaders, Diversity Leaders or Climate Leaders.

Ready to Elevate Your Investing?

Choose the Obermatt subscription that best fits your needs.

30-day money back guarantee. Your subscription will renew until you cancel it, which you can do at any time.

See how Obermatt improved their investing: