The AI story has turned into a clash of ecosystems. NVIDIA still dominates AI chips, but Alphabet (Google) is quietly building the infrastructure, platforms, and partnerships that could shape how billions of people use AI every day. Recent deals, like Google powering Apple’s next-generation Siri with Gemini and reports of Meta exploring Google’s custom TPUs, show that AI leadership is no longer just a hardware race. At the same time, NVIDIA continues to scale with enormous demand for its Blackwell chips and long-term agreements to supply AI supercomputing capacity.

For investors, the question is no longer only “Who sells the fastest chip?” but “Which business model and balance sheet are better positioned for the long term?” To answer that, we unlock all 15 detailed ranks usually reserved for the Unlimited subscription to compare NVIDIA and Google. The results might surprise you.

The Showdown: 15 Obermatt Ranks Unlocked

While the market is still infatuated with NVIDIA, our deep-dive analysis reveals a more nuanced picture. Here is how the two heavyweights stack up.

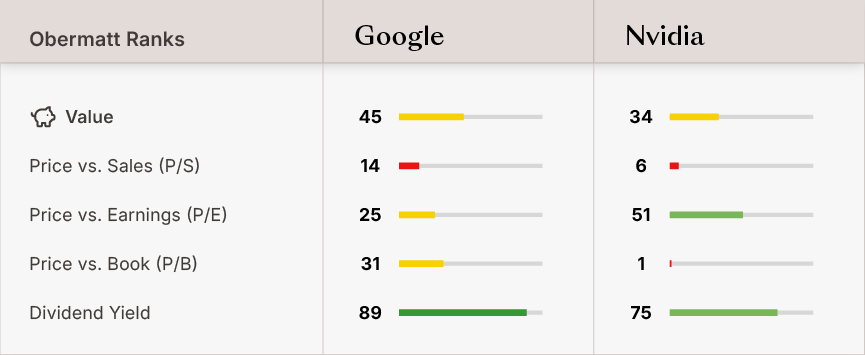

Value: Expensive vs. "Less" Expensive

| Rank | ||

|---|---|---|

| Obermatt Value Rank | ||

| What's driving this? Unlocked: Market-to-Book | Reasonable | Expensive |

Neither stock is "cheap"—that’s the price of admission for high-flying tech. However, Google’s Value Rank of 49 offers significantly better value than NVIDIA (Value Rank 30).

While both carry premium valuations, the detailed metrics show a stark difference in Market-to-Book (or Price/Book, P/B). NVIDIA’s P/B couldn’t be any worse, sitting at a rock-bottom rank of 1. That means that it is trading at one of the most expensive multiples relative to its assets in the entire market.

Meanwhile, Google holds a more reasonable P/B Rank of 31, offering investors far more asset backing for every dollar invested. Remember that the rank shows how the stock ranks against its peers, not the absolute value of the P/B.

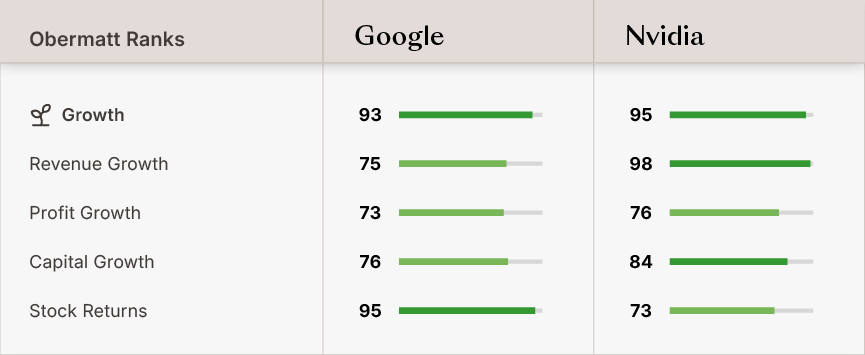

Growth: The Shocking Upset

| Rank | ||

|---|---|---|

| Obermatt Growth Rank | ||

| What's driving this? Unlocked: Stock Returns (TSR) | Superior | Trailing |

While NVIDIA claims the top spot with a Growth Rank of 95, driven by insatiable chip demand, Google is right behind at 93. The difference lies in the composition of that growth. NVIDIA is enjoying a historic revenue spike, but Google remains a compounding machine.

When we look at the Stock Returns (or TSR Total Shareholder Return) metric, Google actually scores a stellar rank of 95, significantly outperforming NVIDIA's Rank 73. This suggests that while NVIDIA is growing its top line faster right now, Google is better at delivering shareholder returns.

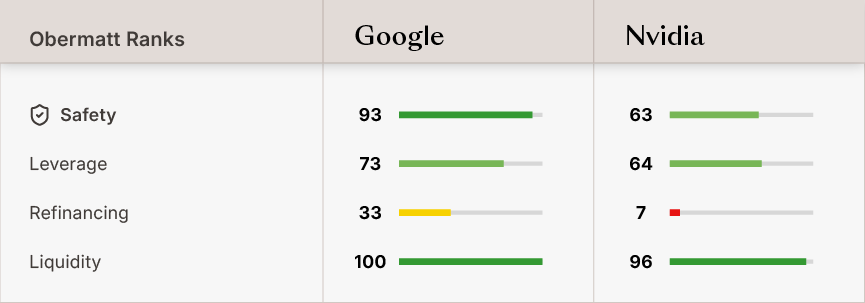

Safety: The Fortress Balance Sheet

| Rank | ||

|---|---|---|

| Obermatt Safety Rank | ||

| What's driving this? Unlocked: Leverage Rank | Fortress | Leveraged |

If volatility makes you nervous, this metric is critical. NVIDIA has a respectable Safety Rank of 63, but it carries higher risks as it aggressively scales.

Google is a financial fortress. A key driver here is Leverage. Google boasts a superior Leverage Rank of 73, significantly outperforming NVIDIA's Rank 64. This indicates that Google is operating with a healthier debt-to-equity buffer, giving it more freedom to weather antitrust fines or fund massive AI infrastructure without financial strain.

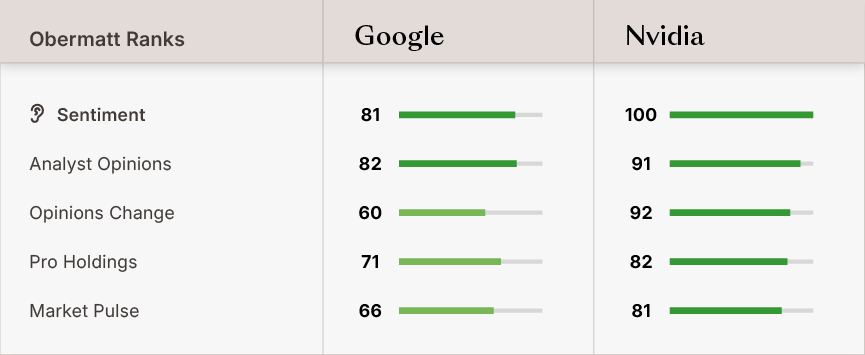

Sentiment: The Market Darling

| Rank | ||

|---|---|---|

| Obermatt Sentiment Rank | ||

| What's driving this? Unlocked: Analyst Opinions | Rational | Euphoric |

NVIDIA holds a perfect Sentiment Rank of 100, driven by a dominant Analyst Opinions Rank of 91. This "perfect" score is a double-edged sword. It means the market is priced for absolute perfection—investors and analysts are unanimously bullish, leaving little room for error. Any hiccup in the Blackwell supply chain could trigger a pullback.

Google’s Analyst Opinions rank of 81 tells a different story. While Wall Street has warmed up to its AI strategy, it isn't "over-loved" like NVIDIA. This suggests that Google’s stock has less "hype premium" baked in, potentially offering a more attractive entry point for investors who worry that the NVIDIA trade has become too crowded.

The Verdict

- Consider Google if you want a balanced, sleep-better-at-night AI investment. While it narrowly trails in growth, it offers a far superior Safety Rank (93), a better Value Rank (45), and a healthier Leverage Rank (73). It is the smarter pick for long-term, risk-adjusted returns.

- Look to Nvidia if you want to ride the pure momentum of the AI hardware boom. The perfect Sentiment Rank (100) and the Growth Rank at 95, it is the undisputed leader of the current AI rally. But beware of the most expensive Rank 1 Price-to-Book valuation.

Discover Alternatives

Sometimes the best stock isn't the one everyone is talking about. Our system scans the market to find specific peers for both companies that might offer better entry points:

- Like Google? Our algorithms point to Meta Platforms, which shares similar digital ad dynamics but is now making its own hardware moves.

- Like NVIDIA? Our system flags Micron (MU) as a similar stock in the semiconductor space, often trading at different valuations.