Quick Facts

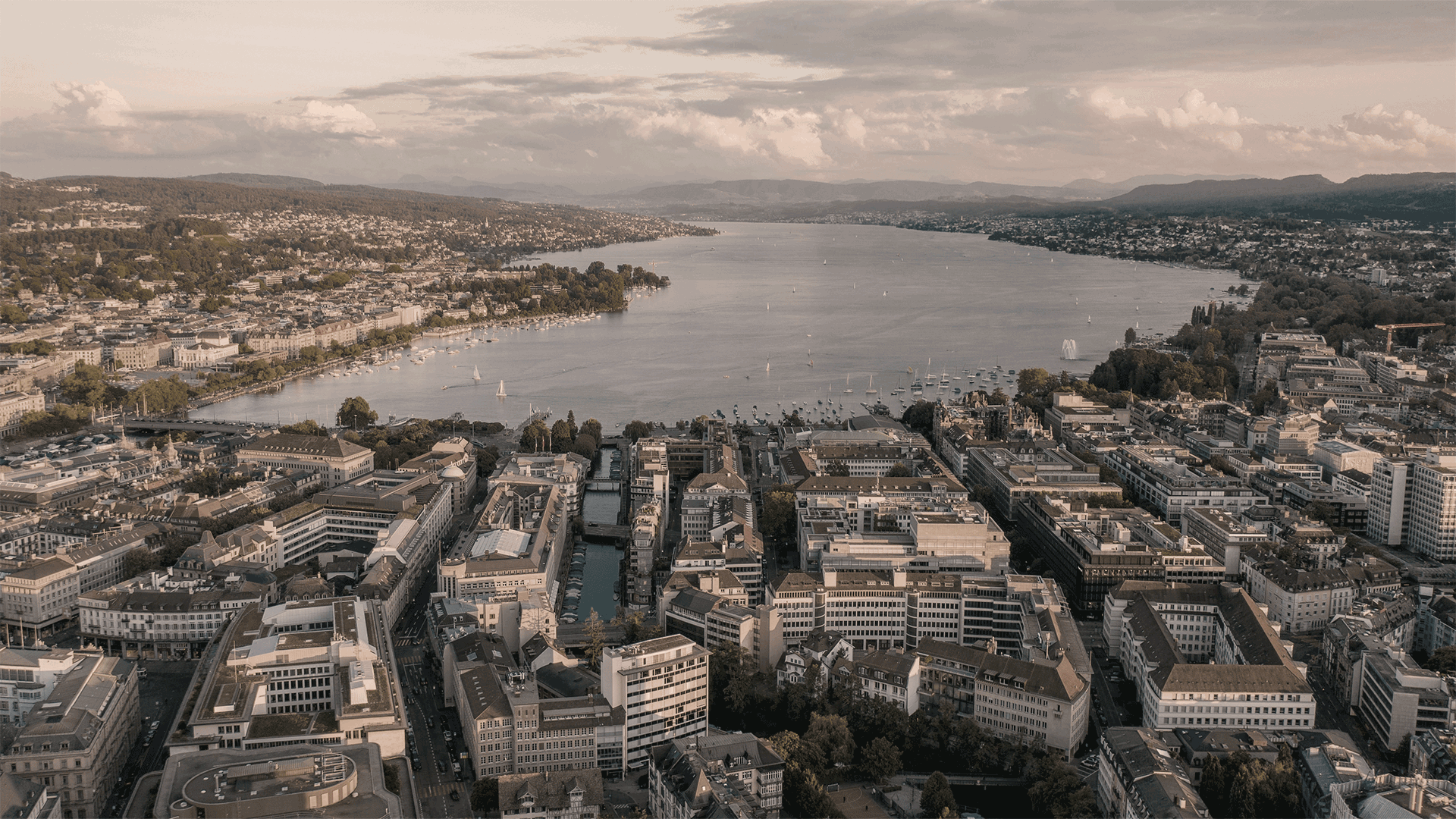

- Intershop Holding AG based in Zurich, is one of Switzerland’s leading real estate companies focusing on high-quality commercial and mixed-use properties.

- Key assets in its portfolio include the Mediacampus Zurich, the Sihl-Center, Puls 5, and Patio — all prime properties located in the heart of Zurich.

- The portfolio has a market value of approximately CHF 1.8 billion with about 560,000 m² of rentable space (mid-2025 figures).

- In the first half of 2025, Intershop posted a net profit of CHF 175.9 million and an operating profit of CHF 36.0 million.

- The equity ratio stood at a solid 56.2%. Additionally, a CHF 100 million bond was successfully issued with a coupon rate of 1.21%.

Pros

- Outstanding financial results in H1 2025 supported by increased rental income and valuation gains.

- Strong balance sheet with high equity ratio and low leverage, providing resilience in volatile markets.

- Active portfolio management with targeted acquisitions, disposals, and investments in prime urban properties.

- Strategic focus on the vibrant Swiss urban real estate market, especially Zurich and selected other regions.

Cons

- Geographic concentration in Switzerland limits diversification and increases exposure to local economic and regulatory risks.

- Rising interest rates may increase financing costs and negatively impact property valuations.

- Economic cycles can affect rental prices and vacancy rates, creating earnings volatility.

Do individual stock purchases and maintaining your stock portfolio take too much of your free time? Check out the first financial product based exclusively on the Obermatt 360° View: Obermatt Swiss Pearls Index.

Intershop’s core strategy is centered on investing in urban, high-growth real estate markets, primarily in Zurich. Iconic properties such as the Mediacampus Zurich, the Sihl-Center, Puls 5, and Patio form the backbone of the portfolio. These assets benefit from prime locations, high occupancy rates, and sustainable value appreciation, providing a stable income foundation which the company continually enhances through active property management and development projects.

Beyond Zurich, Intershop also holds significant assets and development projects across Switzerland in key cities including Basel, Lausanne, St. Gallen, Winterthur, and Baden, as well as in the Lake Geneva region. A notable example is the “AuPark” development in Wädenswil, offering about 230 new residential units, further diversifying Intershop’s portfolio and contributing to its growth potential.

Demographic and urbanization trends strongly support Intershop’s business model. Zurich’s metropolitan area continues to grow at a rate of approximately 0.8% per year, largely driven by immigration. Switzerland’s population is projected to exceed 10.5 million by 2055, with migration as its primary driver. The country’s increasing urbanization — currently over 74% of its population lives in urban areas — fuels demand for modern, multifunctional real estate. The aging population also fosters evolving needs around accessibility and flexible property usage, to which Intershop responds with innovative property development and sustainable management practices.

Financially, Intershop delivers robust results. The first half of 2025 saw record profits boosted by rental growth and property revaluations. A solid equity ratio above 56% combined with prudent financing strategies ensures stability in the face of current market challenges. The successful issuance of a CHF 100 million bond at favorable terms further emphasizes investor confidence and enhances financial flexibility.

This combination of prime real estate locations, consistent earnings, strong balance sheet, and proactive management makes Intershop a compelling new addition to the Obermatt Swiss Pearls Index. For investors, it offers an excellent opportunity to directly participate in Switzerland’s dynamic real estate market with a focus on quality and long-term value creation.