Searching for stock ideas? Explore other Top 10 lists, filter for stocks with our stock filter, or search for individual stocks by signing up.

|

Name

|

360° View

|

Sentiment

|

Combined

|

Value

|

|---|---|---|---|---|

|

1.

M • Asset Management & Custody

|

98

|

14

|

20

|

14

|

|

2.

M • Multi-Utilities

|

95

|

14

|

20

|

14

|

|

3.

M • Household Appliances

|

89

|

14

|

20

|

14

|

|

4.

M • Multi-line Insurance

|

89

|

14

|

20

|

14

|

|

5.

XL • Aerospace & Defense

|

88

|

14

|

20

|

14

|

|

6.

L • Automobile Manufacturers

|

80

|

14

|

20

|

14

|

|

7.

M • Diversified Banks

|

79

|

14

|

20

|

14

|

|

8.

L • Multi-Utilities

|

79

|

14

|

20

|

14

|

|

9.

M • IT Consulting & oth. Services

|

77

|

14

|

20

|

14

|

|

10.

M • Gas Utilities

|

76

|

14

|

20

|

14

|

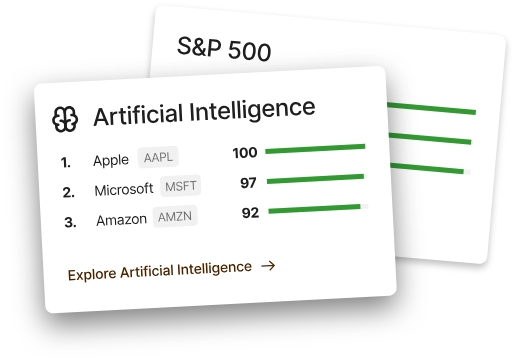

Obermatt's proprietary Investment Themes are a response to investor demand to find the best stocks according their interests, be they high growth areas like AI, Robotics, Renewables, or sustainability values like Governance Leaders, Diversity Leaders or Climate Leaders.

Ready to Elevate Your Investing?

Choose the Obermatt subscription that best fits your needs.

30-day money back guarantee. Your subscription will renew until you cancel it, which you can do at any time.