While many investors are mesmerized by tech stocks, defense stocks and US markets, European markets are going rather unnoticed. In today’s uncertain market climate, we present the European stocks that can provide stability and growth opportunities.

The EURO STOXX 50 is Europe’s leading benchmark index, grouping the 50 largest listed companies in the Eurozone and spanning key sectors such as technology, energy, financials, and industrials. Its diversity and liquidity give investors broad exposure to regional leaders, while its long-standing reputation supports confidence in its holdings.

European stocks stand out now for several reasons. While global attention often gravitates toward US markets, the current environment—with anticipated rate cuts and shifting economic sentiment—favors companies that combine reliable dividends, healthier valuations, and resilience against volatility. Many EURO STOXX 50 companies offer defensive business models and sustainable earnings, making them attractive building blocks for long-term portfolios. For investors wanting to balance their exposure or diversify beyond concentrated US holdings, European blue chips deliver strong fundamentals as well as geographic risk reduction.

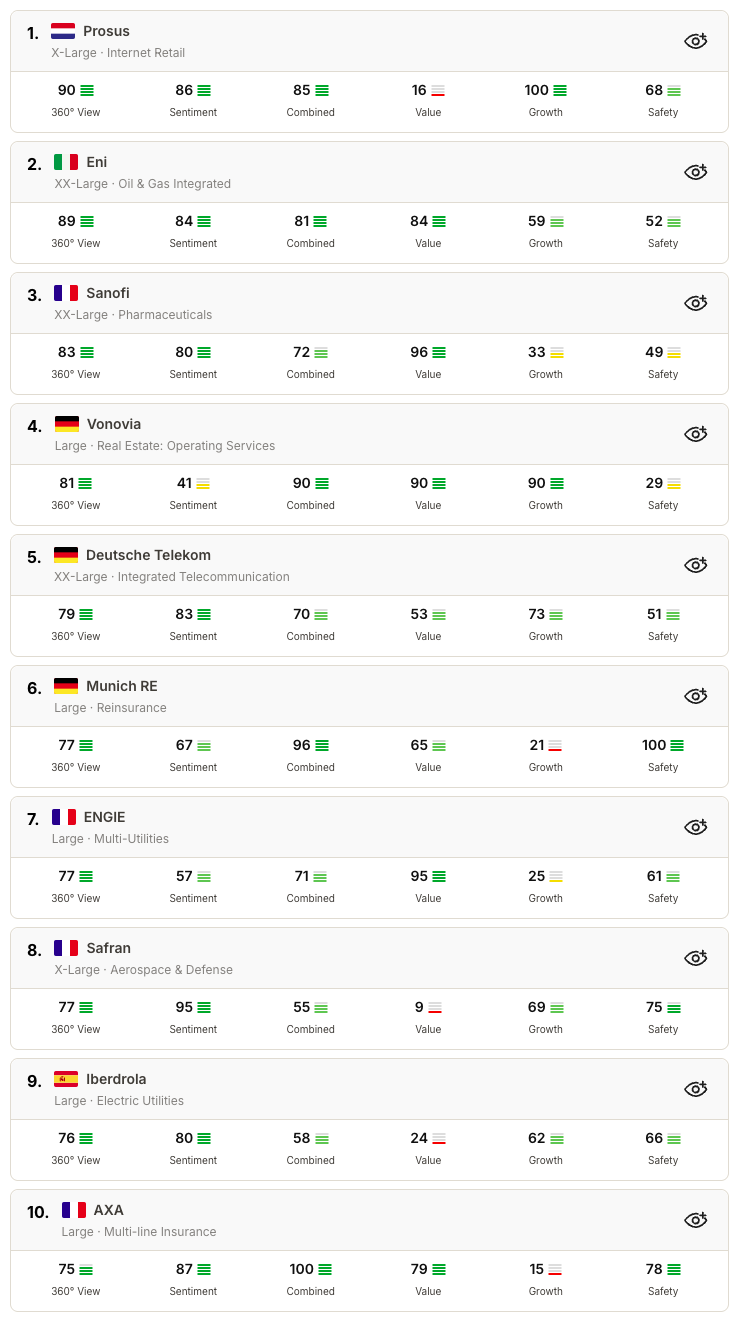

Each month, Obermatt publishes its Top 10 picks in the EURO STOXX 50 using its 360° View—a methodology that balances Value, Growth, Safety, and Sentiment ranks to objectively highlight companies with all-round qualities.

HThis month’s EURO STOXX 50 leaders are:

- Prosus is a global internet group and technology investor based in the Netherlands, with major holdings in social media (Tencent), e-commerce, food delivery, fintech, classifieds, and educational platforms.

- Eni is an Italian multinational energy company active in oil, gas, renewables, and advanced energy technologies. It focuses on exploration, production, refining, and the transition to sustainable energy.

- Sanofi is a French multinational pharmaceutical and healthcare corporation, specializing in prescription medicines, vaccines, and innovative solutions for chronic conditions and infectious diseases.

- Vonovia is Germany's largest residential real estate company, managing, operating, and upgrading extensive housing portfolios throughout the country.

- Deutsche Telekom is a leading integrated telecommunications provider in Europe, offering mobile, broadband, television, and IT services across numerous markets.

- Munich RE is one of the world’s largest reinsurance companies, offering risk management, insurance, and related financial services globally.

- ENGIE is a French-based multinational utility company, providing electricity, natural gas, energy services, and solutions focused on low-carbon and renewable energy.

- Safran is a French aerospace and defense company specializing in aircraft engines, propulsion systems, landing gear, and avionics for civil and military markets.

- Iberdrola is a Spanish multinational utility company leading in global renewable energy, with primary operations in electricity generation, distribution, and smart grids.

- AXA is a French multinational insurance group offering life, property, casualty, and health insurance, serving both individuals and businesses around the world.

As part of our commitment to providing timely insights, Obermatt now publishes Top 10 lists for over 60 markets and indices on the 10th day of every month. To see the full, updated lists and explore our complete analysis, simply log in to your account.

Which stocks belong in your portfolio?

To choose stocks for your portfolio, start your free trial of Obermatt's stock analysis.