Quick Facts

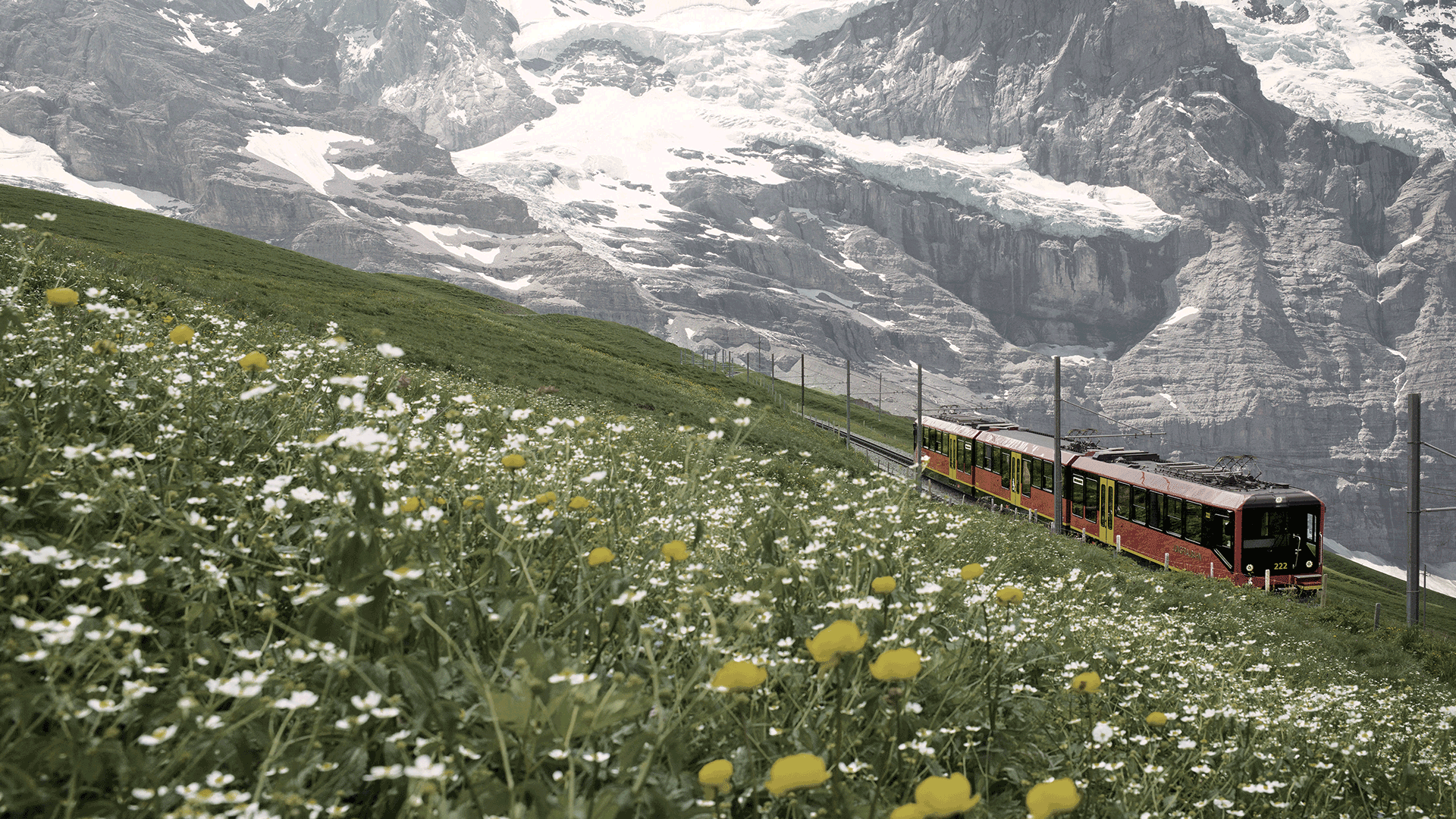

- Jungfraubahn (JFN) is a premier Swiss tourism company that operates mountain railways, cable cars, restaurants, and ski lifts in the Bernese Alps in Switzerland.

- The company is world-famous for operating the "Jungfraujoch – Top of Europe," the continent's highest railway station, located at 3,454 meters (11,332 ft).

- The company generates high-margin revenue by transporting tourists to its unique, exclusive destinations. It also has a significant winter sports segment and a growing "adventure" segment.

- Jungfraubahn recently completed the multi-million franc "V-Bahn" project, a state-of-the-art gondola system that dramatically cuts travel time to the Eiger Glacier and ski areas, enhancing the visitor experience and operational efficiency.

Pros

- JFN has an unrivaled structural moat. It provides the only railway access to the Jungfraujoch, a UNESCO World Heritage site. You cannot build a competitor. This gives it immense and durable pricing power.

- "Top of Europe" is a powerful, globally recognized brand, especially in high-growth Asian markets (China, India, South Korea), where it is a must-see stop on any Swiss tour.

- The post-pandemic recovery is still incomplete, with the crucial, high-margin group travel market from China still recovering. This represents a significant, built-in catalyst for revenue growth as this market continues to normalize.

- With fixed infrastructure costs, every additional visitor adds almost pure profit. A full recovery will lead to a disproportionate jump in profitability.

Cons

- The company is 100% exposed to the global tourism industry. A global recession, health crisis, or geopolitical event can halt business overnight.

- Costs are in strong Swiss Francs (CHF), while revenue comes from tourists spending weaker Euros, Dollars, etc. A rising franc directly squeezes margins and makes Switzerland an expensive destination for tourists.

- A rainy summer or a poor-snow winter directly impacts visitor numbers. This is an uncontrollable risk.

- Running high-alpine railways is incredibly expensive. These costs are fixed, making the company vulnerable in downturns.

For many of us in Switzerland, the Jungfraujoch isn't just a mountain peak; it's a piece of our national identity. The incredible engineering feat of the Jungfraubahn, which has been bringing locals and international tourists up the steep incline for over a century. Jungfraubahnen stands out not just for its engineering projects but also for its solid financial and market profile. This is why it was added to the Obermatt Swiss Pearls Index (OMSP1). The stock scores an impressive 94 (out of 100, at the time of writing) on the Obermatt 360° View, placing it among the top-ranked companies based on value, growth, and safety. This high score is further bolstered by a perfect 100-point Market Sentiment ranking, reflecting strong investor confidence. For the OMSP1, JFN's inclusion is strategic, rounding out the portfolio by adding a high-quality stock from the cyclical tourism sector, a space not previously represented.

This market confidence is built on the company's powerful and diversified business model. While the "Jungfraujoch – Top of Europe" remains the core cash cow, targeting high-yield international tourists, the company has smartly diversified. Its "Experience Mountains" segment, which includes destinations like the Grindelwald-First Cliff Walk and the Harder Kulm viewpoint, successfully captures a younger, more active demographic. This is complemented by the "Winter Sports" segment, a major operator in the Jungfrau Ski Region, which provides a crucial counterbalance to the summer excursion business. The company's market position is, in a word, a dominance. It holds a true monopoly on its crown-jewel asset, a position solidified by the massive capital investment in the new V-Bahn project. This project is a game-changer, making the journey faster, more comfortable, and less weather-dependent, thereby widening its competitive moat.

The outlook for Swiss tourism in late 2025 is robust. The 2024/2025 winter season was a record-breaker, and the 2025 summer has been driven by a full recovery of visitors from North America and strong domestic demand. However, the most significant opportunity still lies ahead. The high-volume, high-margin visitor market from China and other parts of Asia is still notably below its 2019 peak. JFN is already posting excellent results without this key market's full return. As this final piece of the recovery falls into place, the company's high operating leverage is poised to turn that returning revenue into significant profit growth.

The Obermatt Swiss Pearls Index

Invest in a professionally managed index of 36 stocks selected each month using the Obermatt Method, available to retail investors on the SIX Swiss Exchange (Ticker: OMSP1).