Quick Facts

- Integrated Business Model: HIAG manages the entire value chain, from site acquisition and development to long-term property management.

- Diversified Portfolio: With a portfolio valued at approximately CHF 1.9 billion, HIAG isn't overweight on real estate. Instead, its holdings are a balanced mix of industrial/commercial, building land, residential, and office properties.

- Focus on Mixed-Use Areal Spaces: While other real estate companies exist in the OMSP1, HIAG is set apart by its primary focus on transforming large-scale, underutilized sites into vibrant, mixed-use communities.

- Strong Financial Position: The company reported a significant increase in net income for the 2024 financial year and has a solid balance sheet.

Pros

- Value Creation through Site Development: HIAG's unique strategy of acquiring and transforming large-scale sites creates substantial long-term value, as these properties are often in prime locations with high development potential.

- Long-term Stability: The diversified portfolio and focus on sustainable, long-term development projects provide a buffer against short-term market fluctuations and rising interest rates.

- Commitment to Sustainability: The company's sustainability strategy, backed by the successful placement of its first Green Bond, aligns it with modern investor demands and contributes to long-term asset value.

- Proven Financial Performance: Recent strong financial results, including a notable increase in net income, demonstrate the success and resilience of HIAG's business model.

Cons

- Sensitivity to Interest Rates: Despite its resilience, the company's financing costs could be impacted by future increases in interest rates.

- Project-Based Risk: The development of large, complex sites carries inherent risks, such as potential delays and cost overruns. These projects also depend on timely municipal planning and approvals.

Do individual stock purchases and maintaining your stock portfolio take too much of your free time? Check out the first financial product based exclusively on the Obermatt 360° View: Obermatt Swiss Pearls Index.

HIAG Immobilien Holding AG, a leading Swiss real estate company, has distinguished itself through its integrated business model and its strategic focus on developing industrial and commercial sites into high-quality, sustainable urban environments. The company's consistent financial performance and a clear, long-term vision for value creation make it a compelling subject for investors and industry observers. It's no surprise that it is the latest addition to the Obermatt Swiss Pearls Index (OMSP1).

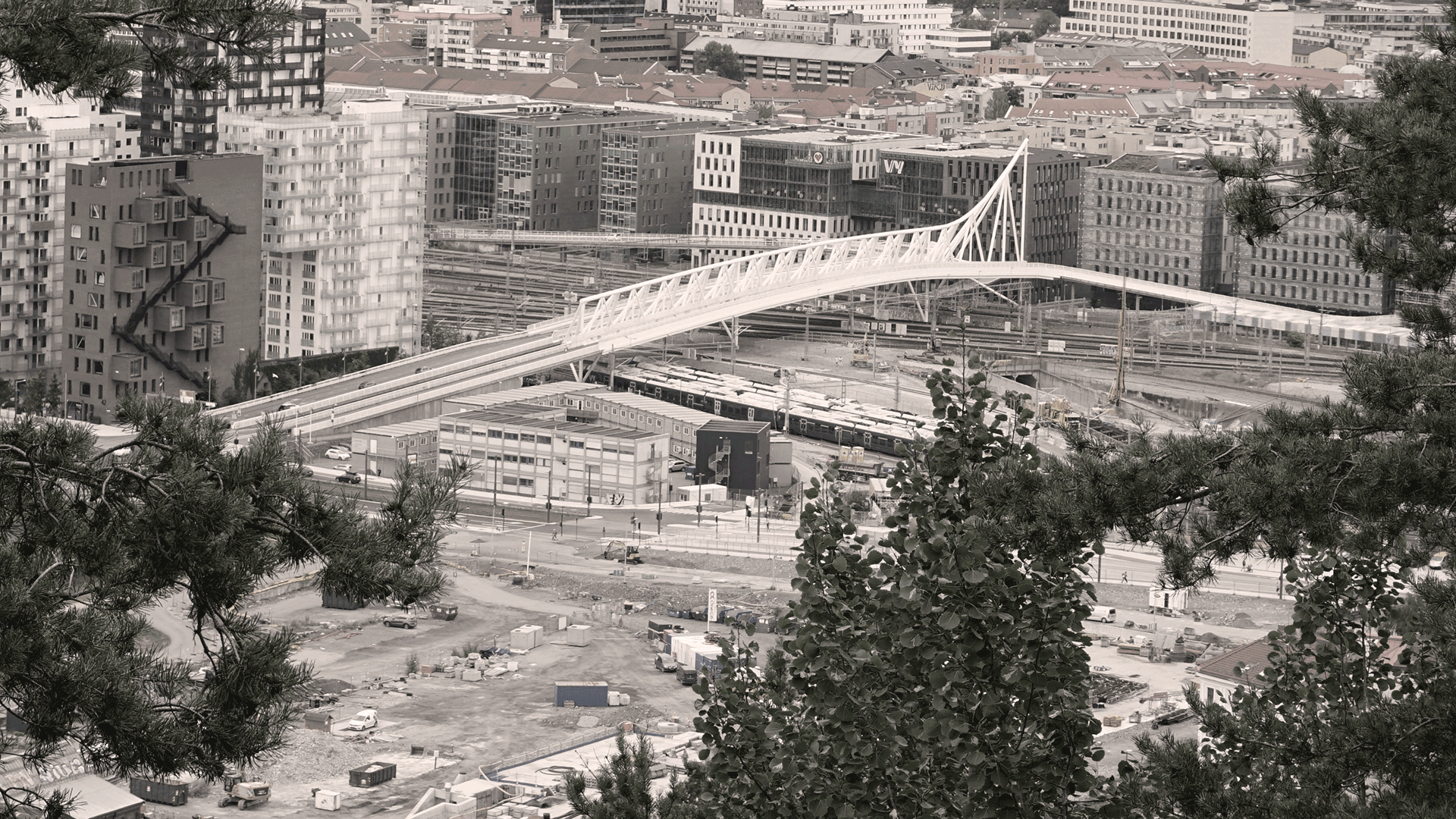

HIAG's business model is centered on its expertise in site development, a process that goes far beyond simple construction. The company acquires large-scale, often neglected, industrial and commercial sites and reimagines them as vibrant, modern communities. These projects, such as the Papieri-Areal in Biberist, are prime examples of HIAG's ability to create value by revitalizing urban spaces.

The company's approach isn't just about new buildings; it's also about active asset management and finding temporary, or "transitional," uses for its properties during the development phase. This generates cash flow and helps to gradually integrate the new sites into the surrounding communities, demonstrating a thoughtful and strategic approach to property management.

HIAG's financial performance in the 2024 financial year was exceptionally strong, with net income increasing to CHF 75.2 million. This growth was a result of strong operational performance and positive revaluations of its development portfolio. The company's ability to achieve such results in a challenging economic environment validates its strategic focus and business model.

By joining the Obermatt Swiss Pearls Index (OMSP1), HIAG is recognized as one of the top 36 Swiss companies based on a data-driven, fact-based analysis. This inclusion highlights the company's strong fundamentals and its position as a "Swiss Pearl."