Anyone who wants to invest regularly in stocks or ETFs will sooner or later come across the term “dollar cost averaging” (DCA). This somewhat unwieldy term refers to a simple method of building up assets over the long term without having to constantly find the perfect entry point.

What is dollar cost averaging?

Dollar cost averaging describes the regular investment of a fixed amount of money in an investment, regardless of whether prices are currently high or low.

This means that you automatically buy more shares when prices are low and fewer when prices are high. Over a longer period of time, this results in an average price that is often more favorable than if you try to catch the best entry point.

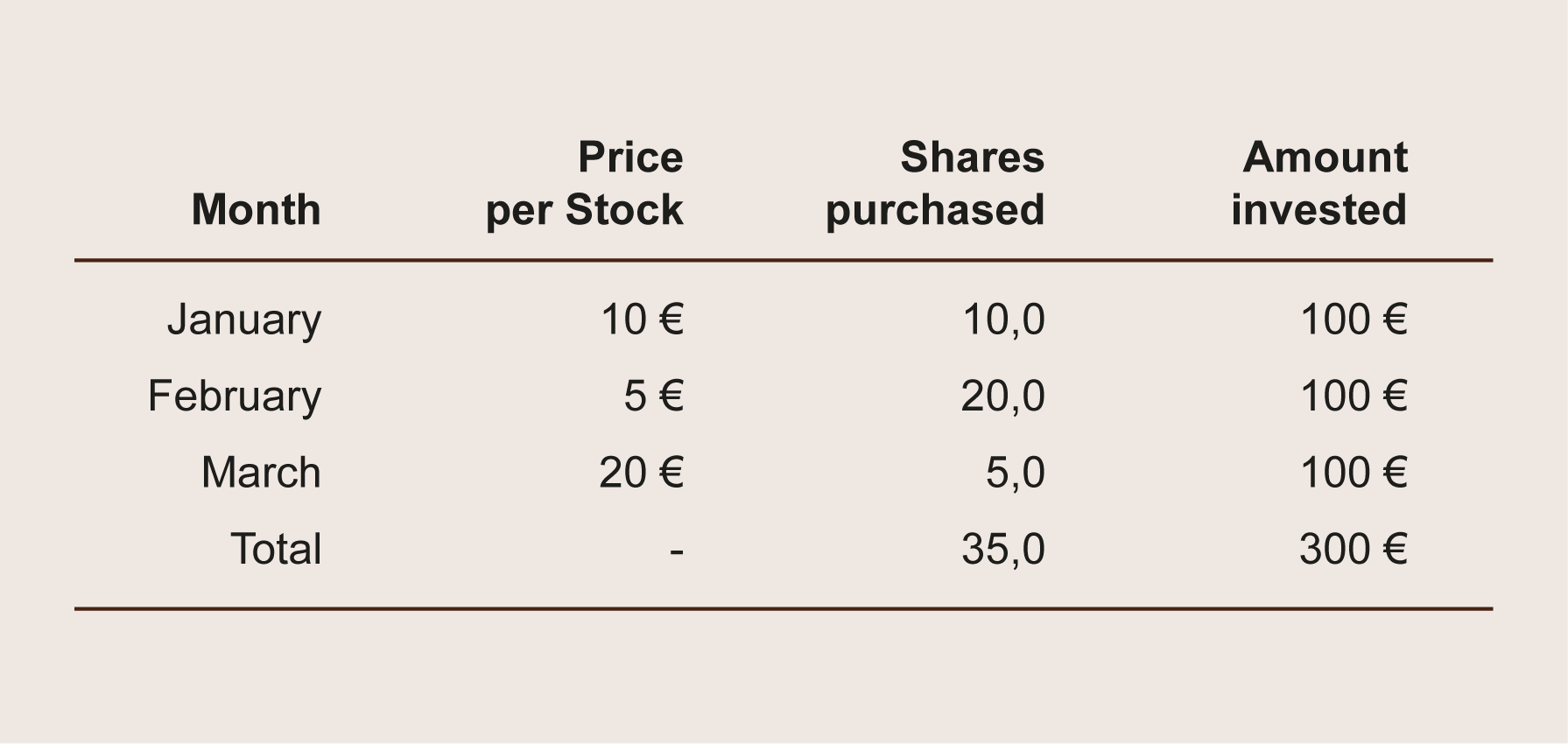

An example to illustrate this:

Assume that EUR 100 is invested in the same stock every month:

The average price per share is therefore around EUR 8.57 (EUR 300 ÷ 35 shares).

How dollar cost averaging has affected performance in history

A historical analysis based on the S&P 500 and the MSCI World provides interesting insights.

One-time investment vs. savings plan - two paths to the same goal?

In theory, DCA often seems safer: you invest small amounts on a regular basis, reduce the risk of a bad entry point and take market fluctuations more calmly. In comparison, with a one-time investment (also called lump-sum), the entire capital is invested immediately, with full risk but also full return potential.

With a total investment of €24,000 (either as a one- time investment or as a monthly savings plan of €100 over 20 years), the following final values would have resulted:

- S&P 500

- Lump sum: ca. 120.000 €

- Savings-plan: ca.77.000 €

- MSCI World

- Lump sum: ca. 67.000 €

- Savings-plan: ca. 46.000 €

The difference is clear: the one-time investment generally brings higher returns in the long term.

Why is that?

The main reason for this is the compound interest effect: capital that is invested earlier benefits from growth for longer. With a savings plan, on the other hand, a lot of money only flows into the market later, which means that the returns are later and lower. In a long-lasting upward trend, this can mean that you buy “more expensively” in the long term and thus benefit less from overall growth.

The best solution?

If you have a larger amount at your disposal and strong nerves, you are generally better off with a one-off investment. Those who prefer to start cautiously can pursue a sensible strategy with DCA, especially if they have regular investable income. A compromise that makes sense for many people: invest the available capital in several larger tranches over a few months in order to combine opportunities and risks in a balanced way and then continue to invest monthly with the regular income.

Benefits of Dollar Cost Averaging:

- No searching for the perfect time: you avoid the stress and uncertainty associated with market timing.

- Even distribution of risk: price fluctuations have less of an impact.

- Simple implementation: Regular investments automatically create a savings routine.

- Emotional distance: You reduce the risk of making wrong purchase decisions driven by emotion.

Are there any disadvantages?

- Potential loss of profit in the event of sharp price rises: Those who already have a larger amount available could benefit when markets rise sharply if the amount is invested immediately or in a few larger tranches, as the analysis of the past 20 years shows. However, weak phases can also be exploited by DCA by temporarily increasing the periodicity or the amount invested.

- No protection against bad investments: Even with the dollar-cost average method, the investments chosen remain decisive.

Who is the method suitable for?

- For beginners who want to invest in a simple and long-term manner.

- For people with a regular income who want to invest on an ongoing basis.

- For investors looking for a stress-free and systematic investment strategy.

How can dollar cost averaging be implemented in practice?

Most online brokers and banks offer the option of setting up savings plans. This allows you to buy stocks or ETFs automatically and regularly, for example on a monthly basis. Investors can start with small amounts. This is particularly popular with ETFs, as they are broadly diversified by nature and reduce the risk of individual stocks. It is important to pay attention to low fees, as these can significantly reduce returns in the long term.

Conclusion:

Dollar cost averaging is a proven method of building up assets over the long term without having to constantly worry about the best time to invest. By investing regularly and taking advantage of price fluctuations, it is often possible to achieve a favorable average price in the long term, ideal for a relaxed, systematic investment.

However, a look at the past 20 years shows that anyone with a larger amount at their disposal could achieve significantly higher returns with a one- time investment. This is because the compound interest effect unfolds its full effect if the capital is invested early and permanently.

Nevertheless, DCA remains a wise strategy, especially for beginners and investors with a regular income. It reduces emotional mistakes, smoothes out fluctuations in the initial phase and creates a disciplined investment routine.

A practicable compromise for many: invest the available capital in several larger tranches over a few months in order to combine opportunities and risks in a balanced way and then continue investing with a monthly savings plan. This combines the advantages of both approaches and allows you to remain invested for the long term without being stressed by timing.

The best strategy? The one that keeps you consistently invested. Whether a savings plan, one-off investment or a combination - the key is to think long-term, act systematically and stay invested.