Across Europe and the globe, geopolitical tensions have triggered a massive reallocation of capital toward defense and security. We are in the early innings of a rearmament super-cycle, where government budgets are expanding, and order backlogs are hitting record highs. For investors, the sector has shifted from a niche "sin stock" play to a core portfolio component. But not all defense stocks are benefiting equally. The market has aggressively picked its winners, inflating valuations for some while leaving others in more reasonable territory. The key now is distinguishing between pure hype and sustainable fundamental value.

Rheinmetall and BAE Systems are the titans of European defense, but they offer completely different propositions to investors. Rheinmetall, headquartered in Düsseldorf, is Germany's leading integrated technology group for security and mobility. It is the powerhouse behind the legendary Leopard 2 main battle tank's 120mm smoothbore gun and the PzH 2000 self-propelled howitzer, while aggressively pushing the future of warfare with its new Panther KF51 tank and Skyranger air defense systems.

In contrast, BAE Systems is the United Kingdom's premier defense contractor and the largest in Europe. Its portfolio is vast, spanning from the Eurofighter Typhoon jet and Astute-class nuclear submarines to the CV90 infantry fighting vehicle. It is also a critical partner in the massive F-35 Lightning II program, delivering a breadth of advanced solutions across air, land, and sea that few can match.

Rheinmetall and BAE Systems offer completely different propositions to investors. Today, we are unlocking the vault. We exposed all 15 detailed ranks normally reserved only for Unlimited Subscribers to see how the two giants really stack up.

The result? One looks better for pure momentum, the other for professional confidence—and the winner depends entirely on your risk appetite.

The Showdown: Growth vs. Sentiment

At first glance, Rheinmetall seems to be the obvious winner in the current defense boom. It is the media darling, the face of European rearmament, and its stock price reflects that. However, Obermatt’s data tells a different story about value and professional sentiment. Here is how they compare across the critical metrics:

Value Rank

| Rank | |||

|---|---|---|---|

| Obermatt Value Rank | |||

| Detail: P/E |

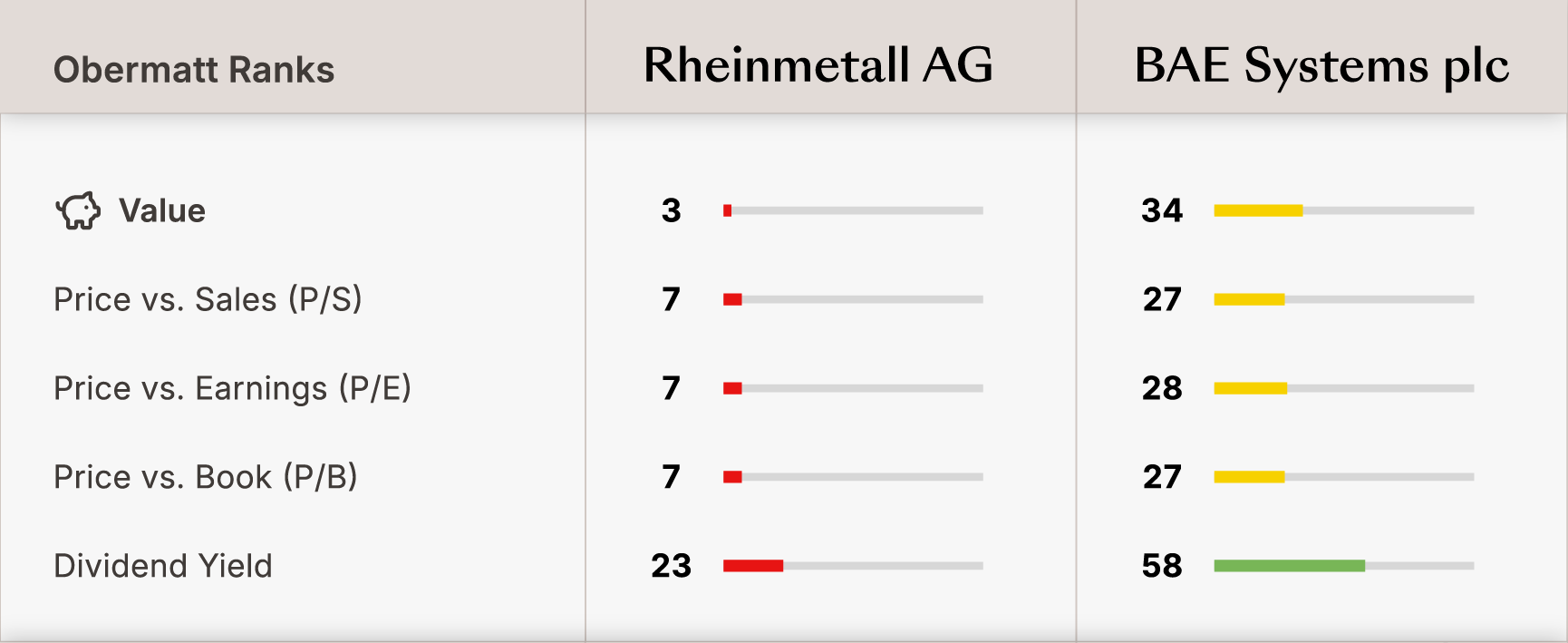

Winner: BAE Systems. Rheinmetall’s massive stock price run-up has crushed its Value Rank down to a mere 3. Breaking this down, its Price-to-Earnings (P/E) Rank is a rock-bottom 7, meaning it is more expensive than 93% of comparable companies. The market has priced in perfection.

BAE Systems, while not cheap, offers a far more grounded valuation. Its P/E Rank of 28 is still in the lower tier, indicating it trades at a premium, but it offers a significantly better entry point than Rheinmetall. BAE trades at levels that sustain investor returns even if growth slows, whereas Rheinmetall needs to keep sprinting just to justify its price tag.

Growth Rank

| Rank | |||

|---|---|---|---|

| Obermatt Growth Rank | |||

| Detail: Revenue |

Winner: Rheinmetall. This is where Rheinmetall dominates. With a perfect Growth Rank of 100, it is statistically unbeatable in this category. The sub-ranks confirm this dominance: its Revenue Growth Rank is a perfect 100, reflecting an aggressive expansion in operations, factories, and assets that few peers can match.

BAE Systems is more steady-state. Its Obermatt Growth Rank is 40 and its Revenue Growth Rank is 64, showing healthy but not explosive expansion. This shows BAE is managing its existing massive infrastructure rather than aggressively building new capacity like its German rival. If you want a company that is "all-in" on expansion, Rheinmetall is the clear choice.

Safety Rank

| Rank | |||

|---|---|---|---|

| Obermatt Safety Rank | |||

| Detail: Refinancing |

Winner: Tie (Both Low). Defense contractors often carry significant leverage. Both companies score low here, but Rheinmetall edges out a win with a Safety Rank of 44 compared to BAE's 22. However, the details are critical: both have very low Refinancing Ranks (Rheinmetall 16, BAE 18), highlighting potential friction in their debt structures. Investors in this sector must accept that these are capital-intensive businesses with balance sheets that often look stretched compared to tech or consumer goods.

Sentiment Rank

| Rank | |||

|---|---|---|---|

| Obermatt Sentiment Rank | |||

| Detail: Opinions Change |

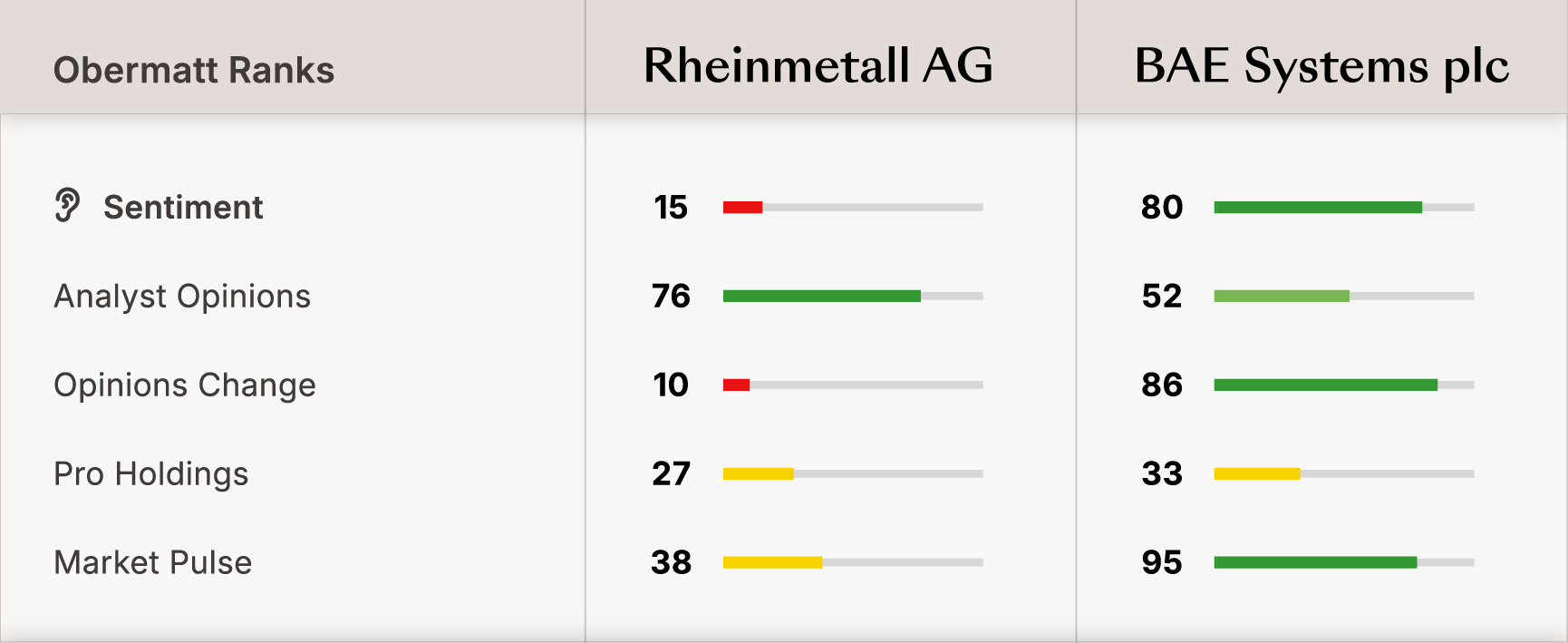

Winner: BAE Systems. This is the most shocking divergence. Despite Rheinmetall's public hype, its Sentiment Rank is a critical 15. A closer look reveals a worrying trend: its Opinions Change Rank is a low 10, suggesting that the wave of upgrades has stalled or even begun to reverse.

In stark contrast, BAE Systems boasts a healthy Sentiment Rank of 80. This is supported by an excellent Opinions Change Rank of 86, which reflects improving professional consensus. Unlike the volatile excitement surrounding Rheinmetall, the sentiment around BAE is improving and confident, suggesting that institutional investors see it as the more reliable long-term play.

The Verdict

- Rheinmetall if you are a momentum trader who believes the European rearmament super-cycle will continue. The 100 Growth Rank is undeniable, though the low Sentiment score is a warning sign.

- BAE Systems if you want exposure to defense but prefer a company with strong professional backing (Sentiment Rank 80) and a valuation that offers a better margin of safety.