Quick Facts

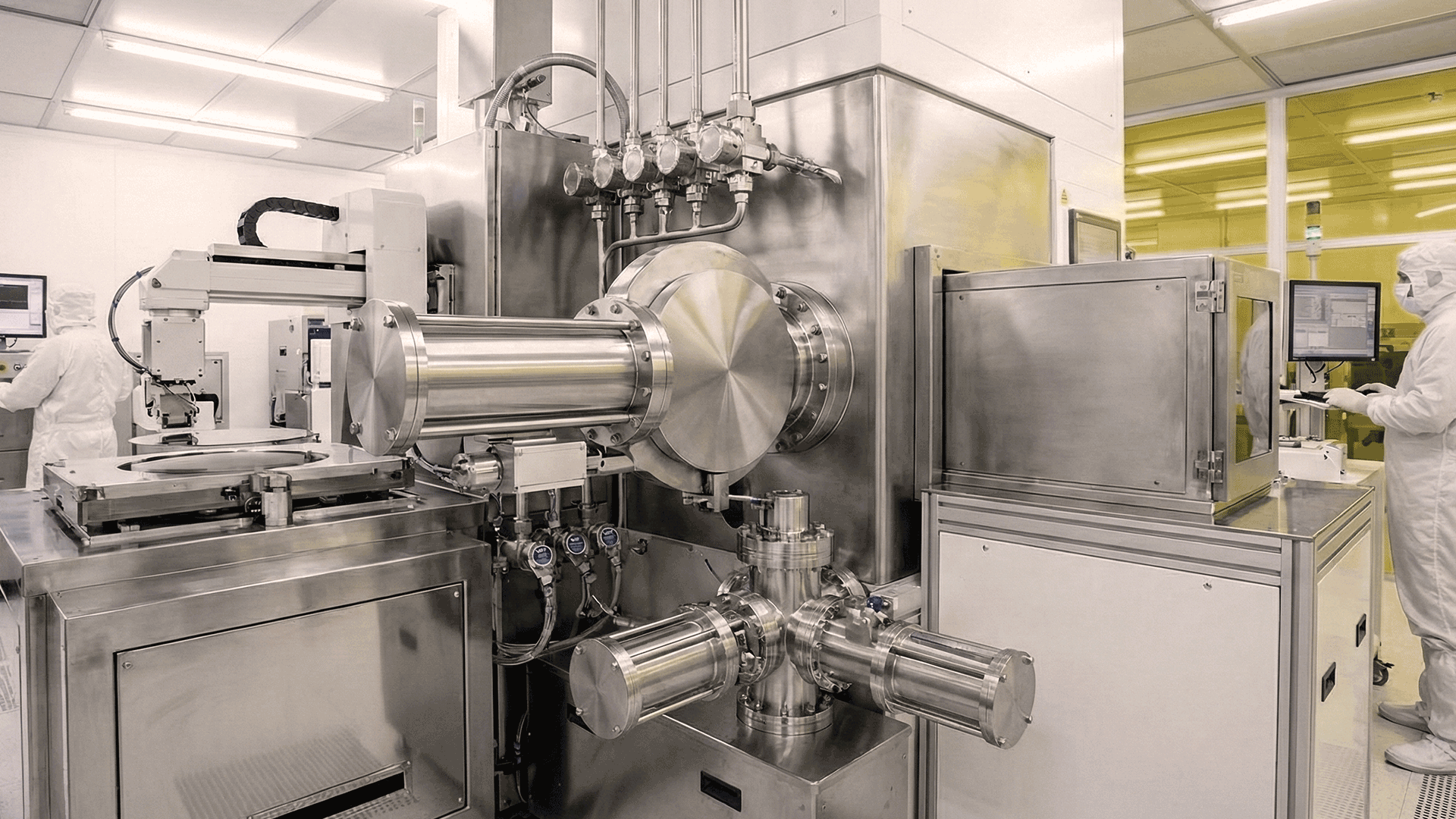

- Unrivaled Position: VAT Group holds a staggering 75% global market share for vacuum valves in the semiconductor sector. If a factory is building high-end chips, they are using VAT.

- The AI Connection: Modern AI processors (like those from NVIDIA) cannot be manufactured in regular air. VAT’s technology creates the essential vacuum environment for these chips.

- The Momentum: Order books are exploding. Q4 2025 orders jumped 28% to CHF 305 million as global fabrication plants ramp up for 2026.

Pros

- The "2nm" Moat: As chips get smaller (approaching the 2nm standard), the manufacturing difficulty skyrockets. VAT is often the sole certified supplier for these processes, creating a massive barrier to entry for competitors.

- Algorithm Approval: The Obermatt Growth Rank has turned green, reflecting the recovery of the global semiconductor cycle.

- Profit Scaling: With new production hubs fully operational in Malaysia and Romania, VAT is ready to satisfy this new demand surge with optimized margins.

Cons

- Cyclical Volatility: Even with the AI boom, VAT is tied to capital expenditure cycles. When chipmakers pause spending, VAT’s stock price reacts sharply.

- Premium Price: You rarely get VAT "on sale." Its Value Rank is typically lower than traditional industrial stocks because the market prices it for high growth.

Everyone talks about NVIDIA. But almost no one talks about the Swiss engineering that makes NVIDIA’s chips possible. Modern AI processors require a production environment of absolute purity—a technical challenge that VAT Group solves more effectively than any competitor globally.

VAT Group (VACN) returns to the Obermatt Swiss Pearls Index (OMSP1) this month. After the stock was removed in early 2025 during a sector-wide cooling phase, our algorithm has registered a renewed "Buy" signal for January 2026, driven by significantly improved Growth and Sentiment metrics.

The Structural Driver: The investment case relies on the hardware requirements of Artificial Intelligence. The shift toward High Bandwidth Memory (HBM) and 2nm chip architectures demands significantly higher vacuum intensity than previous generations. VAT has secured its role as the critical supplier for this transition, serving key equipment manufacturers like ASML and Applied Materials.

The Obermatt 360° View indicates that the market has repriced VAT not merely as an industrial manufacturer, but as a specialized technology enabler. While the stock trades at a premium valuation, this reflects its high barriers to entry. For the OMSP1, VAT Group provides essential exposure to the semiconductor capex cycle, backed by the financial stability of a Swiss market leader.

Invest in a professionally managed index of 36 stocks selected each month using the Obermatt method. Available for retail investors on the SIX Swiss Exchange (Ticker: OMSP1). Learn more